Credit Cards, the MoneyView Way

A whole new experience - moving from redirection to integration

A whole new experience - moving from redirection to integration

Role

SR. PRODUCT DESIGNER

Category

UX DESIGN / UI DESIGN / PRODUCT STRATEGY

Date

May 16, 2025

I led the redesign of Moneyview's credit card experience, transforming a 95% abandonment rate into an empowering financial discovery journey.

I led the redesign of Moneyview's credit card experience, transforming a 95% abandonment rate into an empowering financial discovery journey.

DESIGN

DESIGN

Me (Lead UX Designer)

Arun Murugesan (Head of Design)

Rajesh Thangappan (Design Manager, Growth)

Aneesh R (Motion Designer)

Manuel Tom (UI Designer)

Sudharshan (Lead UI Designer)

RESEARCH

RESEARCH

Arijeet Chatterjee

Vidyasagar Mane

PRODUCT & ENGINEERING

PRODUCT & ENGINEERING

Joel Joseph (Stakeholder)

Deepankar Raj (Driver)

Sarashwati (Frontend Developer)

Aravind Raj (Developer)

Prateek Srivastava (Backend Developer)

/CREDIT CARD DISCOVERY

/CREDIT CARD DISCOVERY

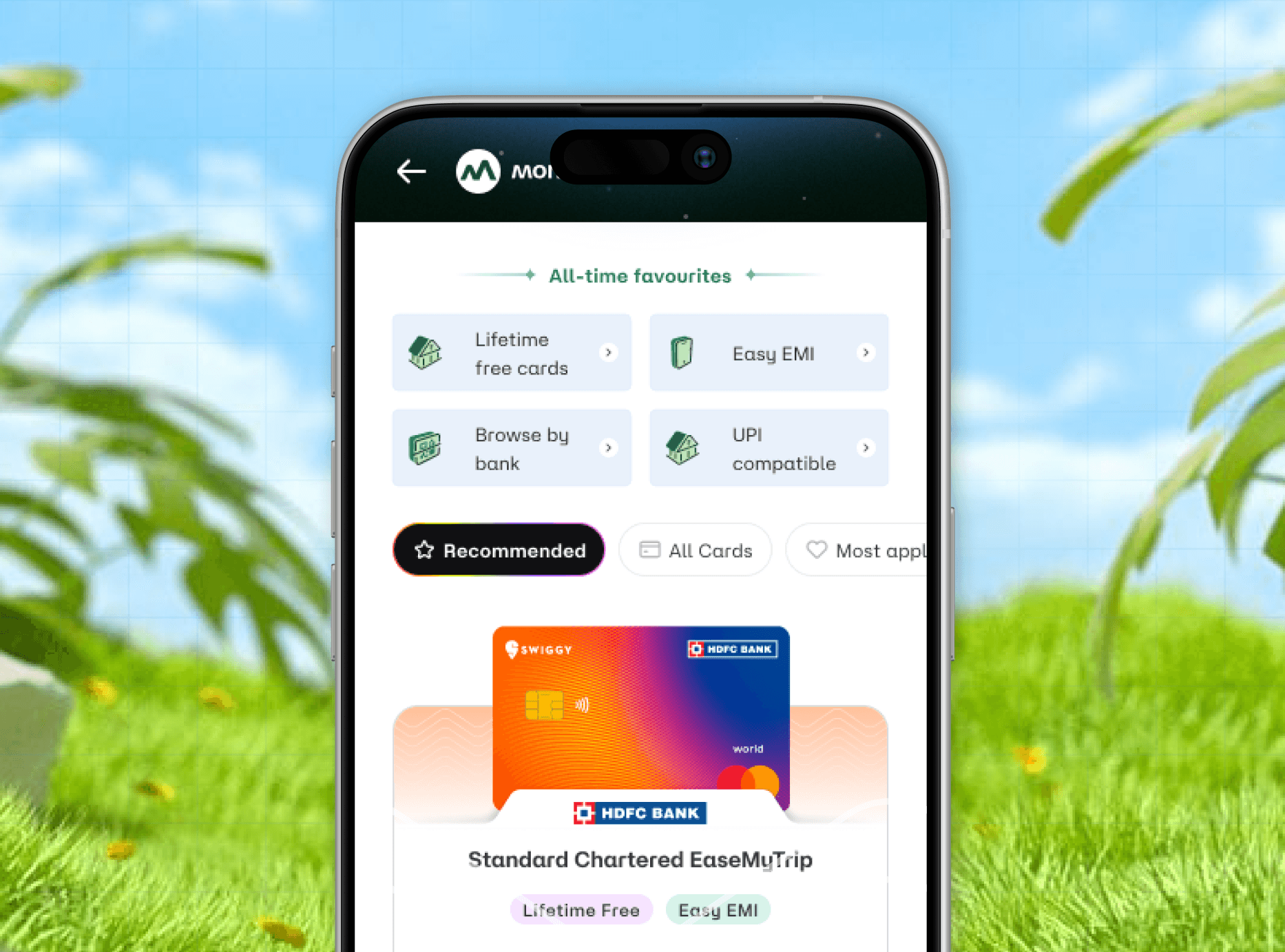

Moneyview's Credit Card Discovery platform helps users find, compare, and apply for credit cards with confidence.

Moneyview's Credit Card Discovery platform helps users find, compare, and apply for credit cards with confidence.

/ THE CHALLENGE

/ THE CHALLENGE

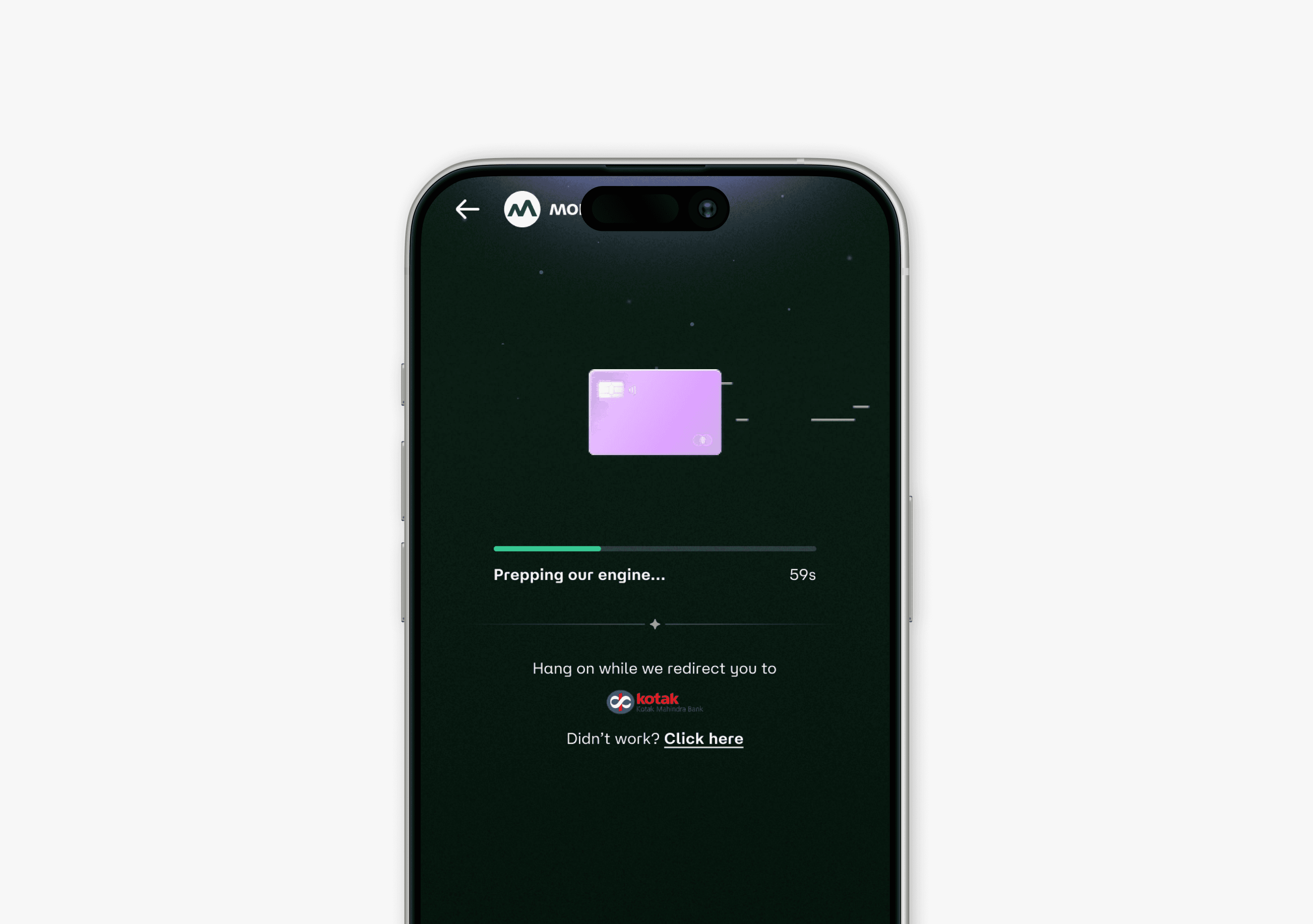

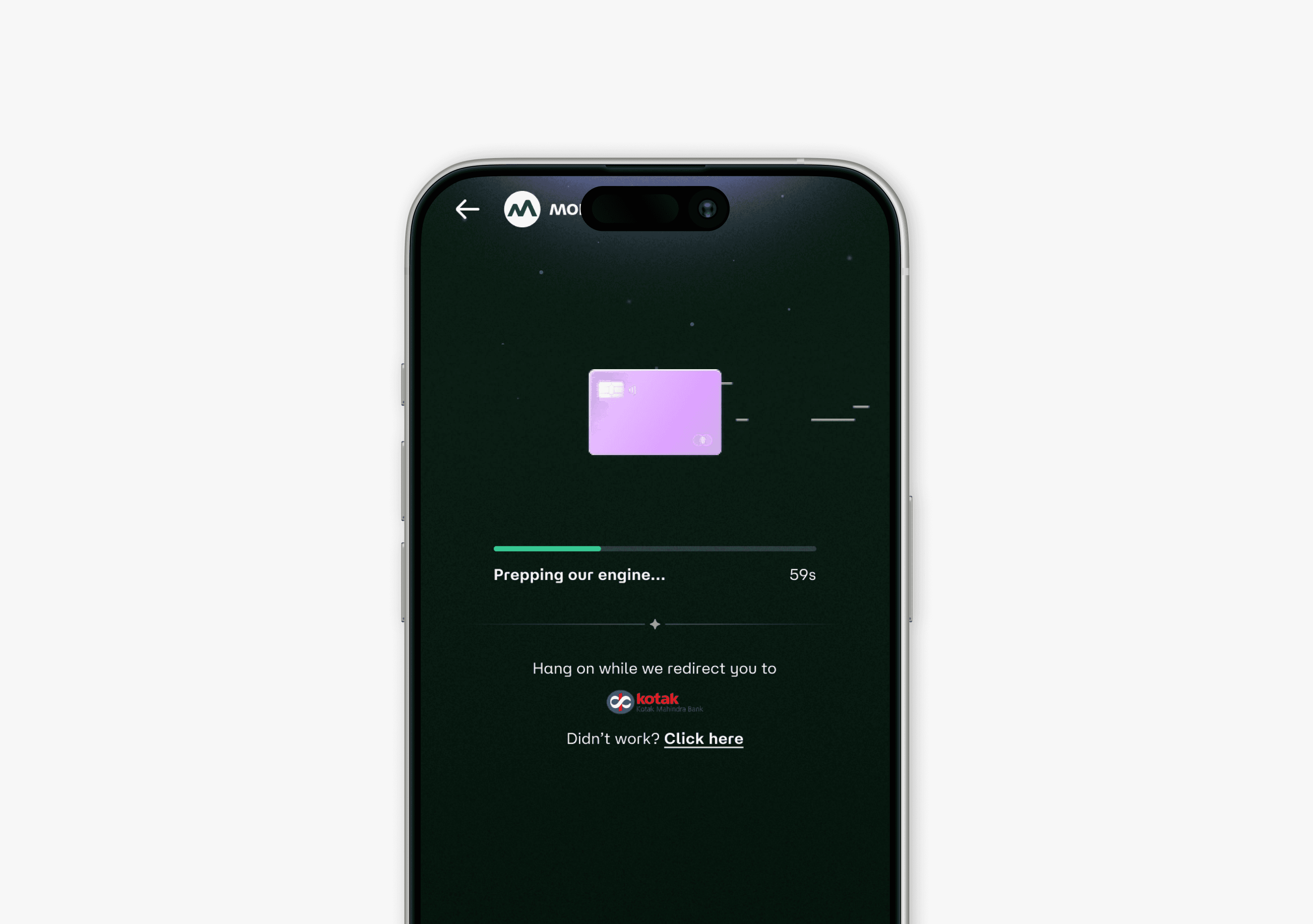

Credit Card Discovery 1.0

Credit Card Discovery 1.0

When 95% of users abandon their credit card applications, you know something is fundamentally broken. Our existing platform demanded users complete 18 form fields before they could even see available cards—imagine shopping blindfolded with your hands tied.

The numbers told a stark story: users weren't just leaving; they were fleeing from confusion, overwhelm, and anxiety about making the wrong financial decision.

When 95% of users abandon their credit card applications, you know something is fundamentally broken. Our existing platform demanded users complete 18 form fields before they could even see available cards—imagine shopping blindfolded with your hands tied.

The numbers told a stark story: users weren't just leaving; they were fleeing from confusion, overwhelm, and anxiety about making the wrong financial decision.

When 95% of users abandon their credit card applications, you know something is fundamentally broken. Our existing platform demanded users complete 18 form fields before they could even see available cards—imagine shopping blindfolded with your hands tied.

The numbers told a stark story: users weren't just leaving; they were fleeing from confusion, overwhelm, and anxiety about making the wrong financial decision.

/VERSION-1 /AUG 2025 / THE EXISTING EXPEREINCE

/VERSION-1 /AUG 2025 / THE EXISTING EXPEREINCE

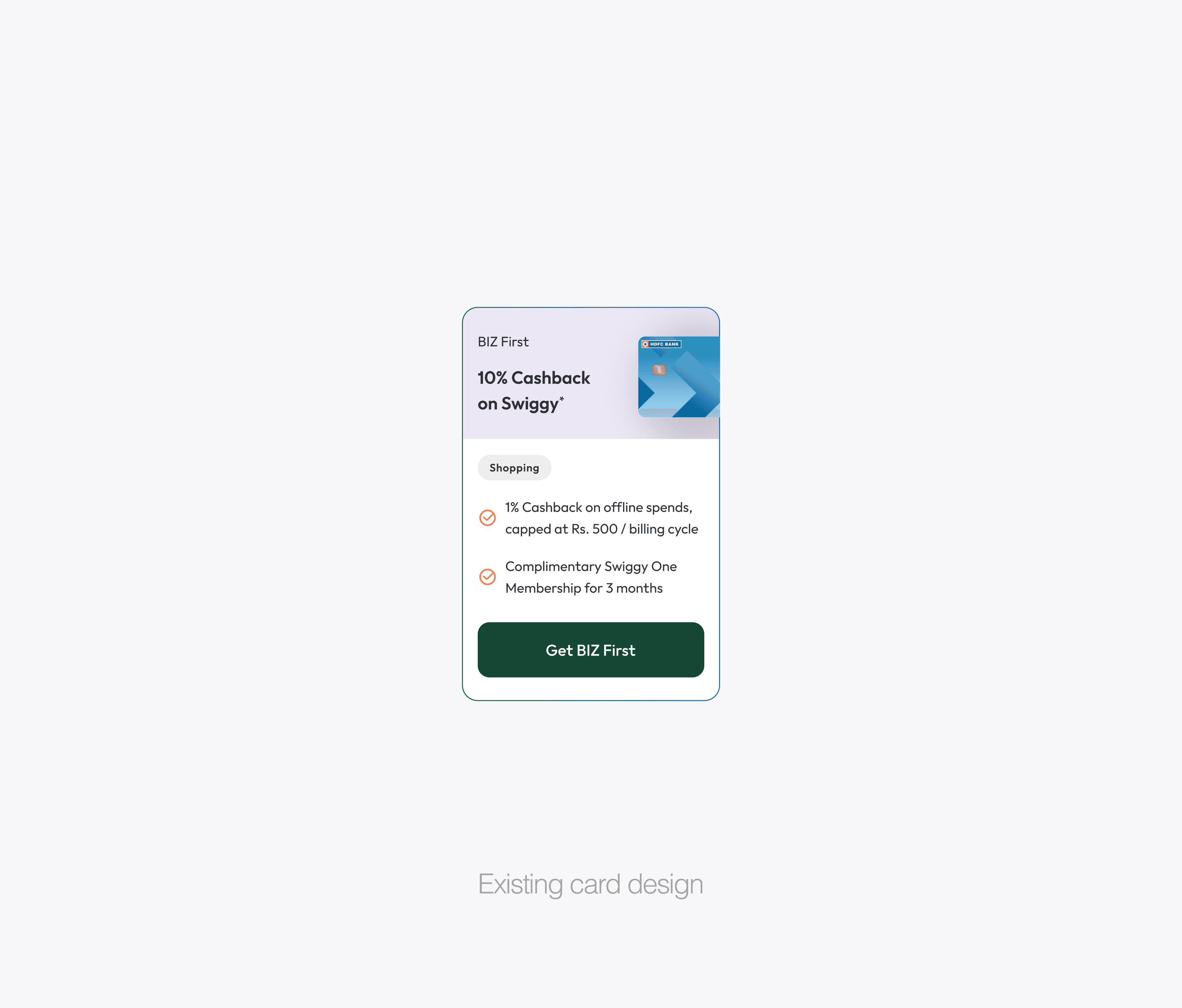

The Problem We Inherited

The Problem We Inherited

The original experience forced users through an 18-field application form before revealing any card options. Information was scattered across disconnected screens, with no comparison tools or application tracking.

Users abandoned at a staggering 95% rate, overwhelmed by complexity and rejection anxiety.

Fragmented journey:

Form completion before card discovery Information overload: Dense, unstructured card details Missing tools: No filtering, comparison, or status tracking Anxiety-inducing: Rejection fears amplified by poor UX

The original experience forced users through an 18-field application form before revealing any card options. Information was scattered across disconnected screens, with no comparison tools or application tracking.

Users abandoned at a staggering 95% rate, overwhelmed by complexity and rejection anxiety.

Fragmented journey:

Form completion before card discovery Information overload: Dense, unstructured card details Missing tools: No filtering, comparison, or status tracking Anxiety-inducing: Rejection fears amplified by poor UX

The original experience forced users through an 18-field application form before revealing any card options. Information was scattered across disconnected screens, with no comparison tools or application tracking.

Users abandoned at a staggering 95% rate, overwhelmed by complexity and rejection anxiety.

Fragmented journey:

Form completion before card discovery Information overload: Dense, unstructured card details Missing tools: No filtering, comparison, or status tracking Anxiety-inducing: Rejection fears amplified by poor UX

/OUR APPROACH

/OUR APPROACH

Reimagining Financial Decision-Making

Reimagining Financial Decision-Making

We shifted from asking "How do we get more applications?" to "How do we help users make confident financial choices?"

Our focus areas became:

Scannable information architecture - letting users process options quickly

Progressive disclosure - showing what matters when it matters

Integrated application management - removing artificial barriers between discovery and tracking

Our approach placed card comparison and filtering at the forefront, ensuring users could explore options with confidence and clarity.

We shifted from asking "How do we get more applications?" to "How do we help users make confident financial choices?"

Our focus areas became:

Scannable information architecture - letting users process options quickly

Progressive disclosure - showing what matters when it matters

Integrated application management - removing artificial barriers between discovery and tracking

Our approach placed card comparison and filtering at the forefront, ensuring users could explore options with confidence and clarity.

We shifted from asking "How do we get more applications?" to "How do we help users make confident financial choices?"

Our focus areas became:

Scannable information architecture - letting users process options quickly

Progressive disclosure - showing what matters when it matters

Integrated application management - removing artificial barriers between discovery and tracking

Our approach placed card comparison and filtering at the forefront, ensuring users could explore options with confidence and clarity.

/DESIGN PHILOSOPHY

/DESIGN PHILOSOPHY

Empowering Financial Confidence

Empowering Financial Confidence

Core principles that guided every design decision:

1. Immediate actionability - Users should feel empowered to act at every step

Clarity over complexity - Every element needed to earn its place by reducing cognitive load

Transparent comparison - Financial decisions require clear, honest information

Anxiety reduction - Design should build confidence, not create doubt1.

Core principles that guided every design decision:

1. Immediate actionability - Users should feel empowered to act at every step

Clarity over complexity - Every element needed to earn its place by reducing cognitive load

Transparent comparison - Financial decisions require clear, honest information

Anxiety reduction - Design should build confidence, not create doubt1.

Core principles that guided every design decision:

1. Immediate actionability - Users should feel empowered to act at every step

Clarity over complexity - Every element needed to earn its place by reducing cognitive load

Transparent comparison - Financial decisions require clear, honest information

Anxiety reduction - Design should build confidence, not create doubt1.

/USER RESEARCH

/USER RESEARCH

Understanding Financial Behavior

Understanding Financial Behavior

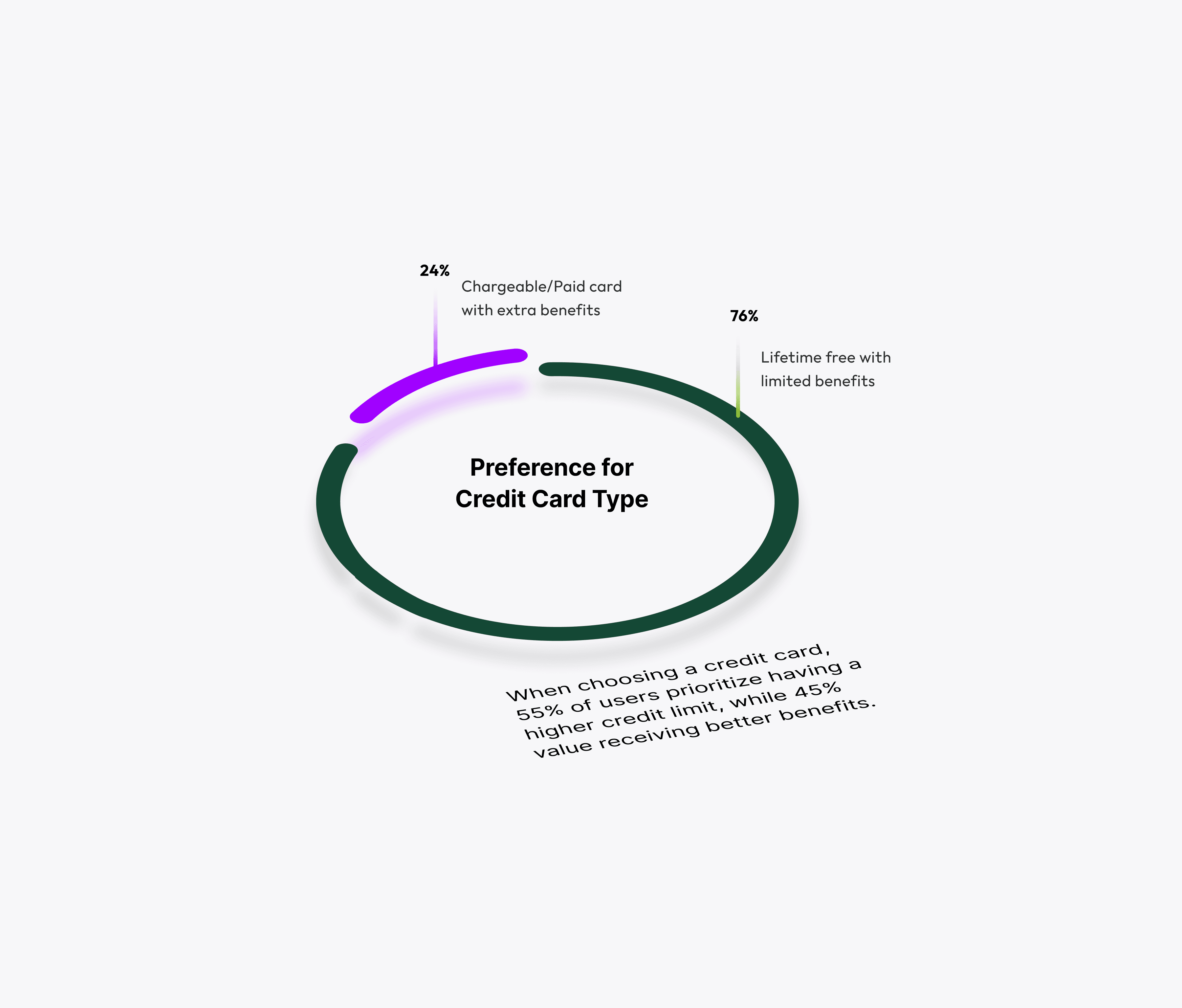

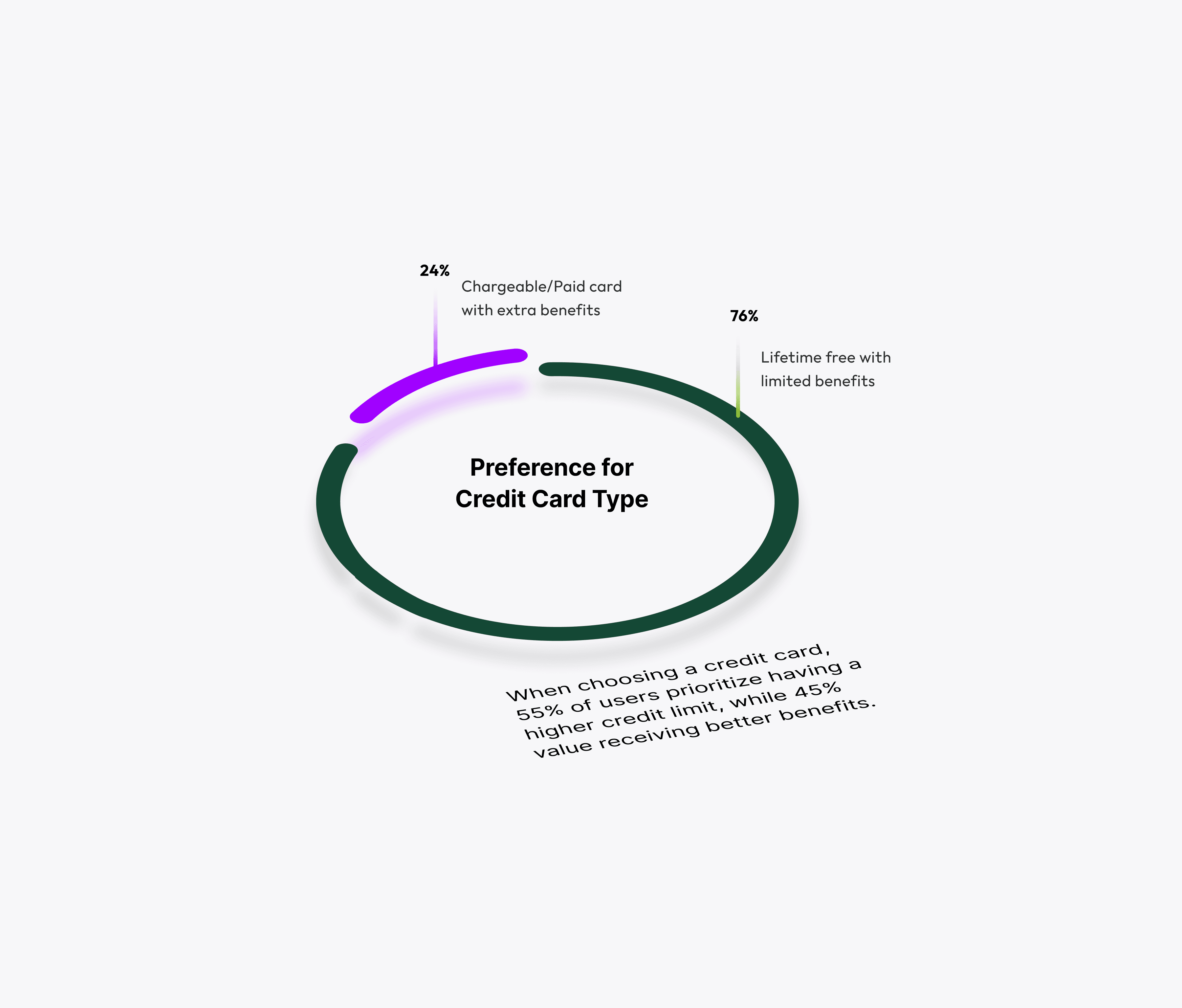

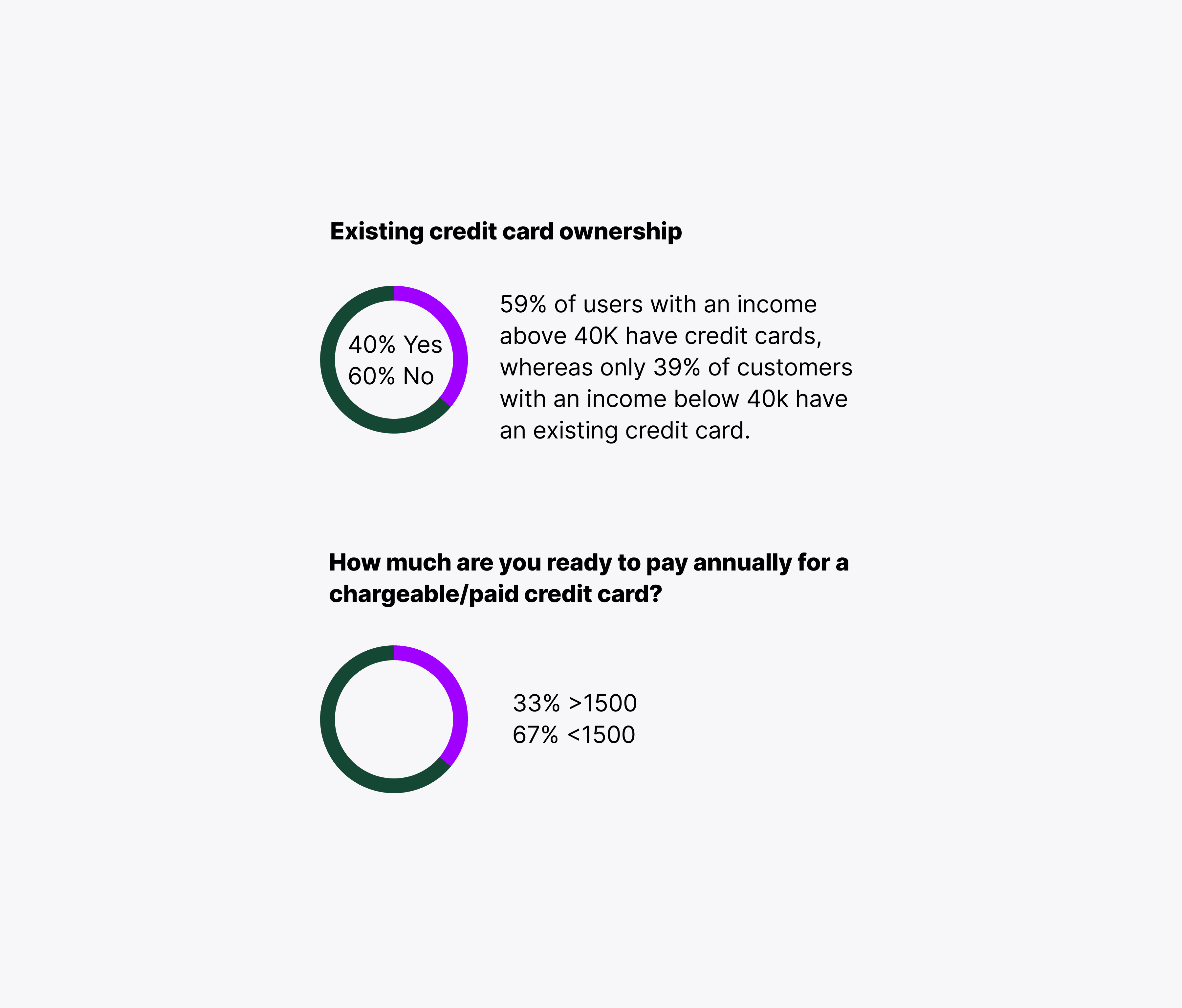

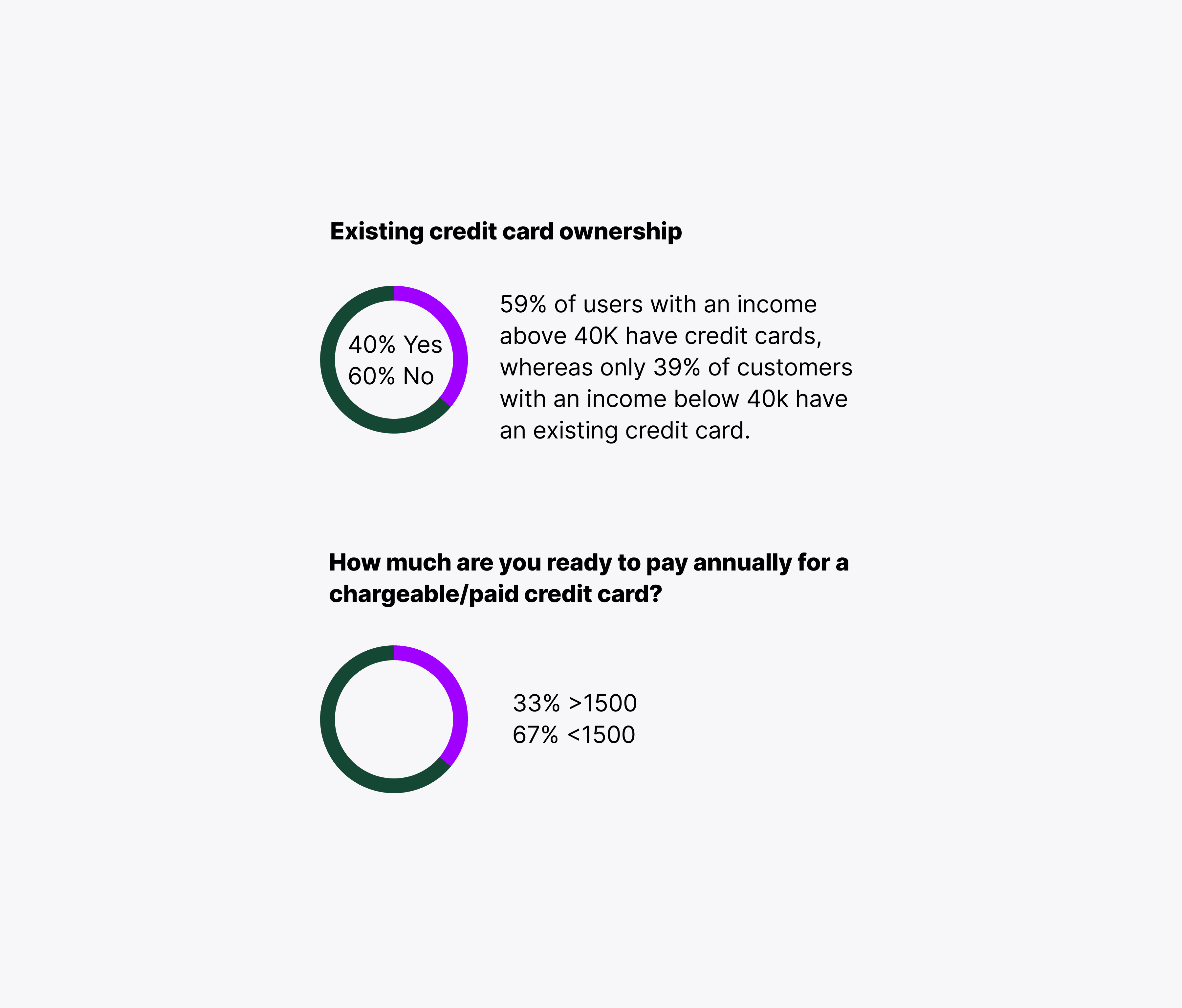

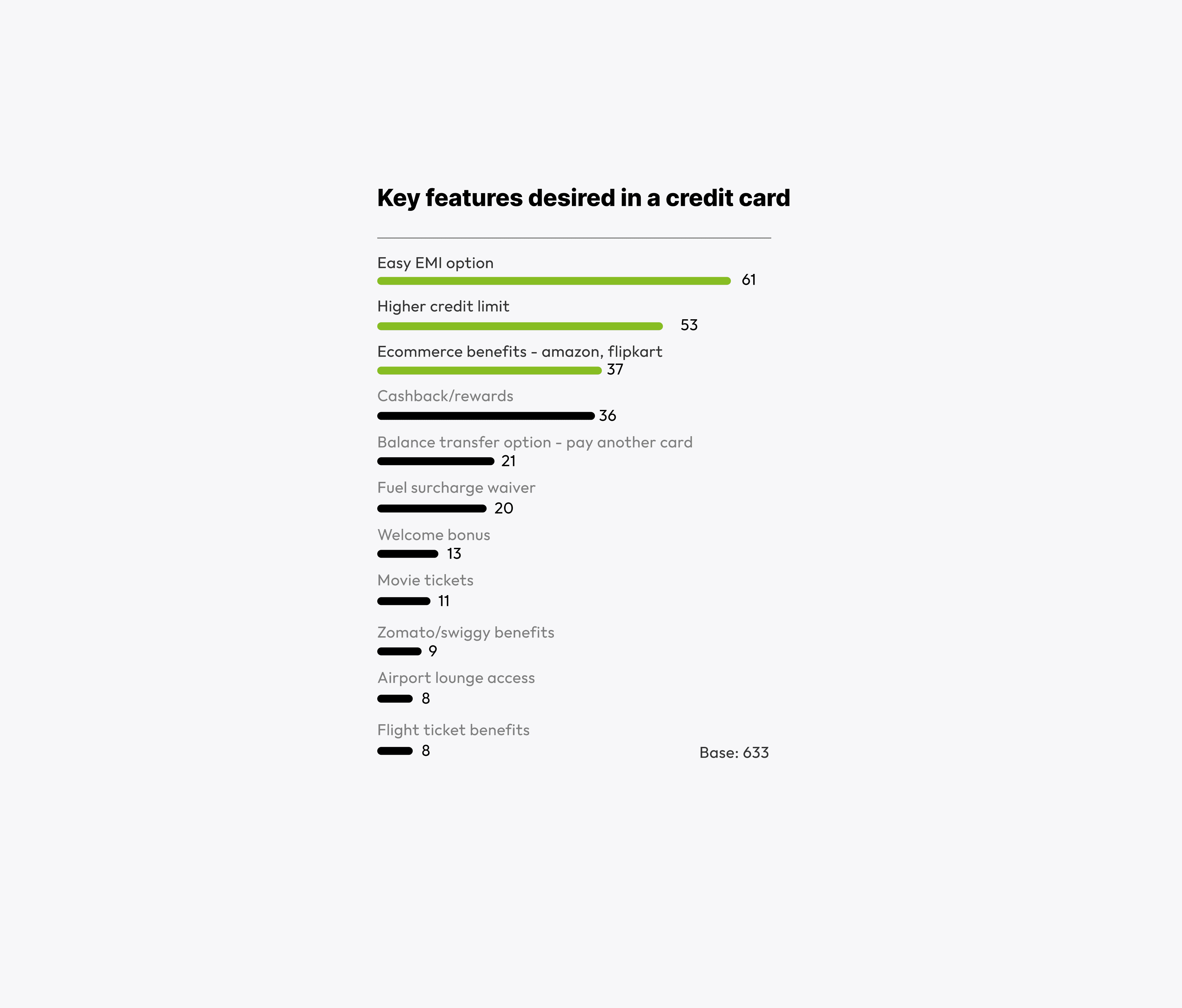

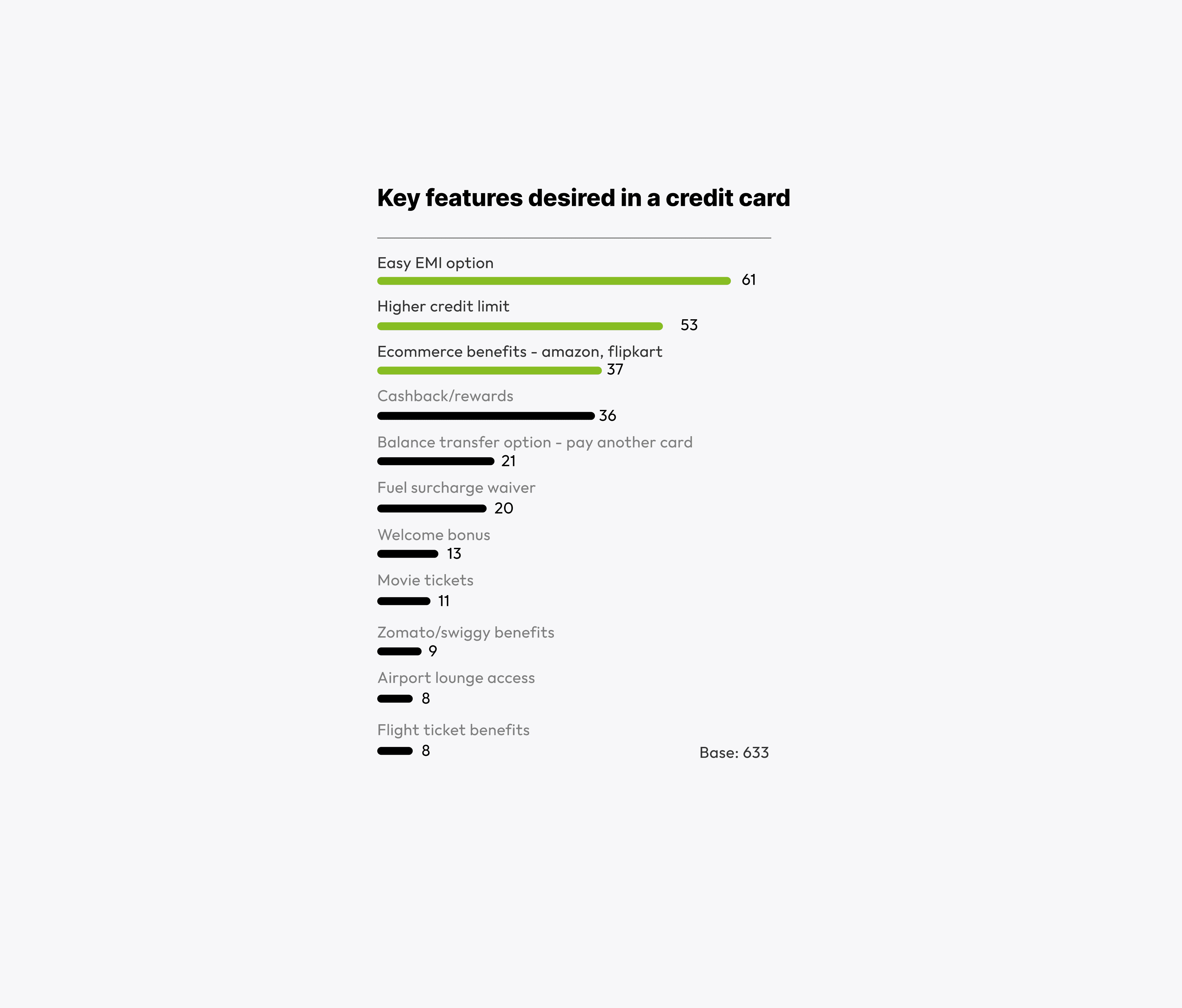

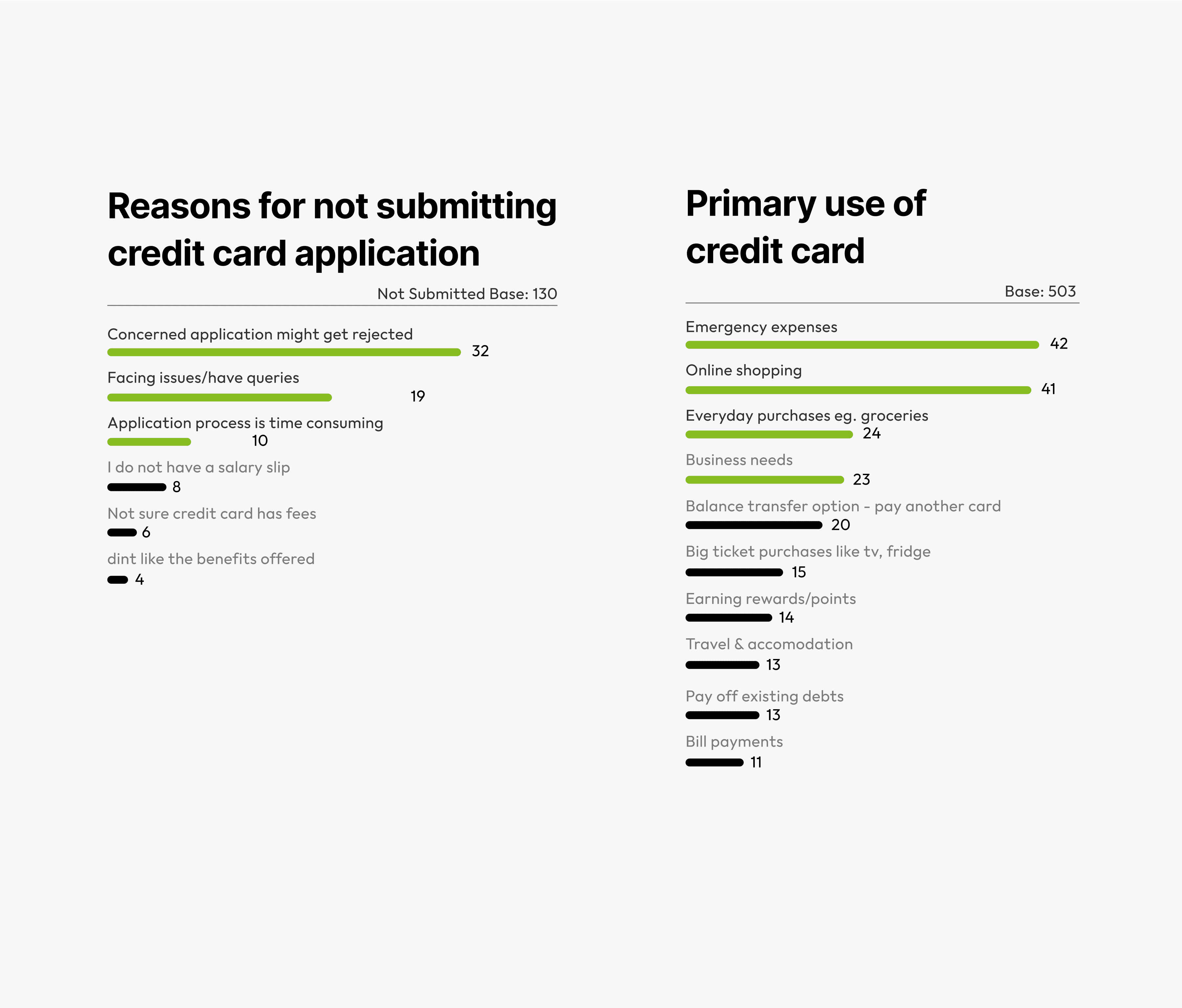

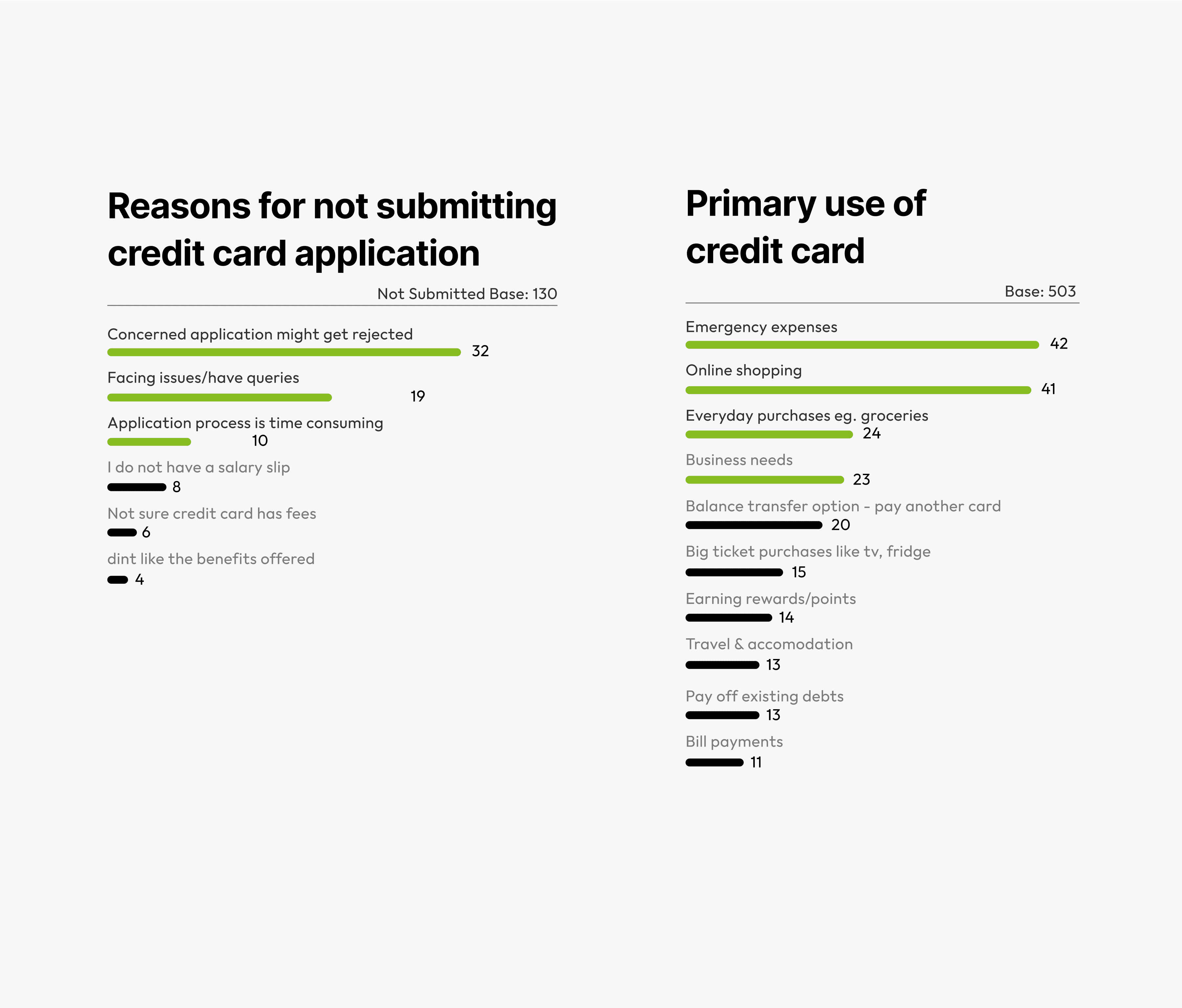

Primary motivations emerged clearly: online shopping (63%), emergency expenses (62%), and major purchases (55%). Application abandonment stemmed from rejection anxiety (105 users) and process complexity (59 users).

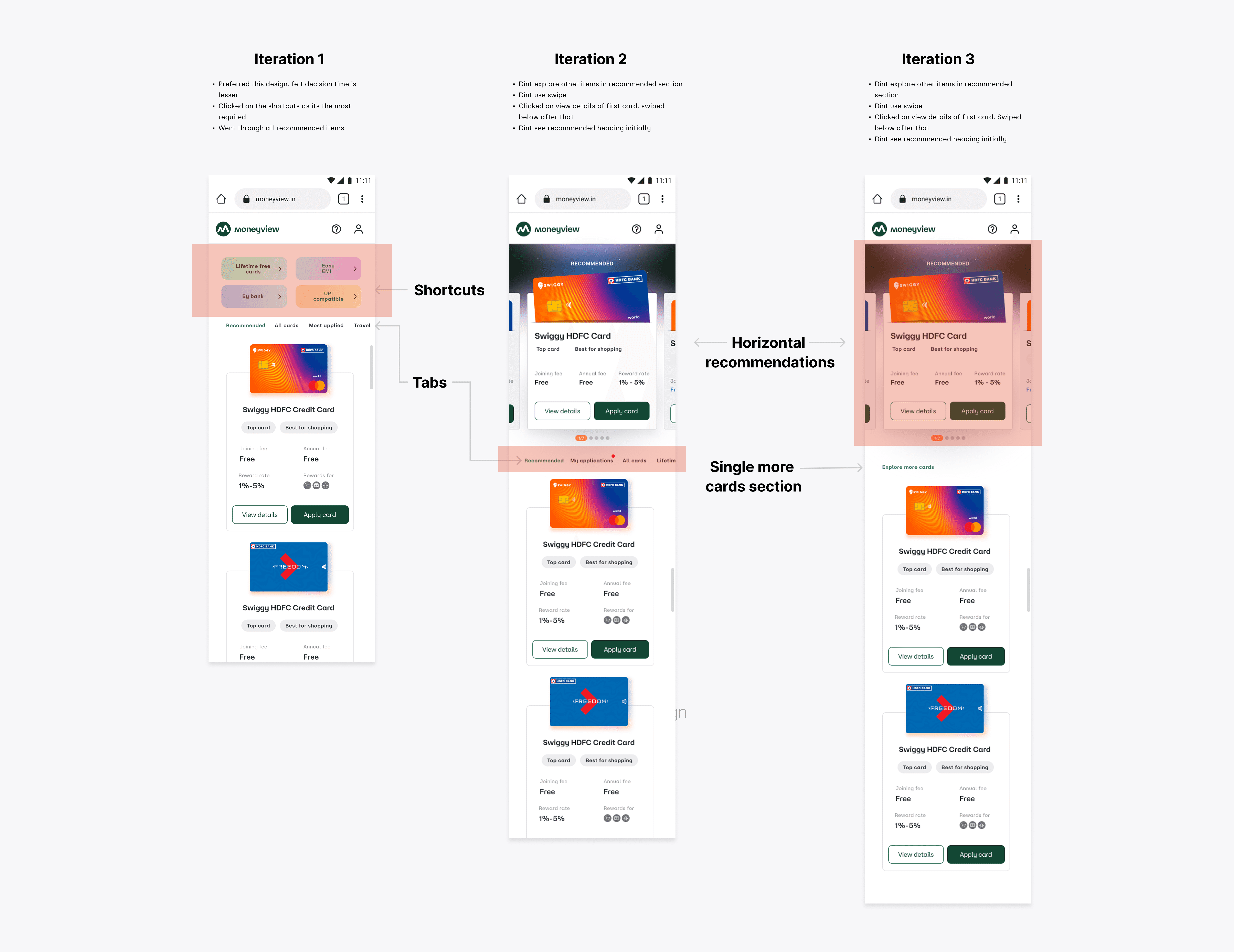

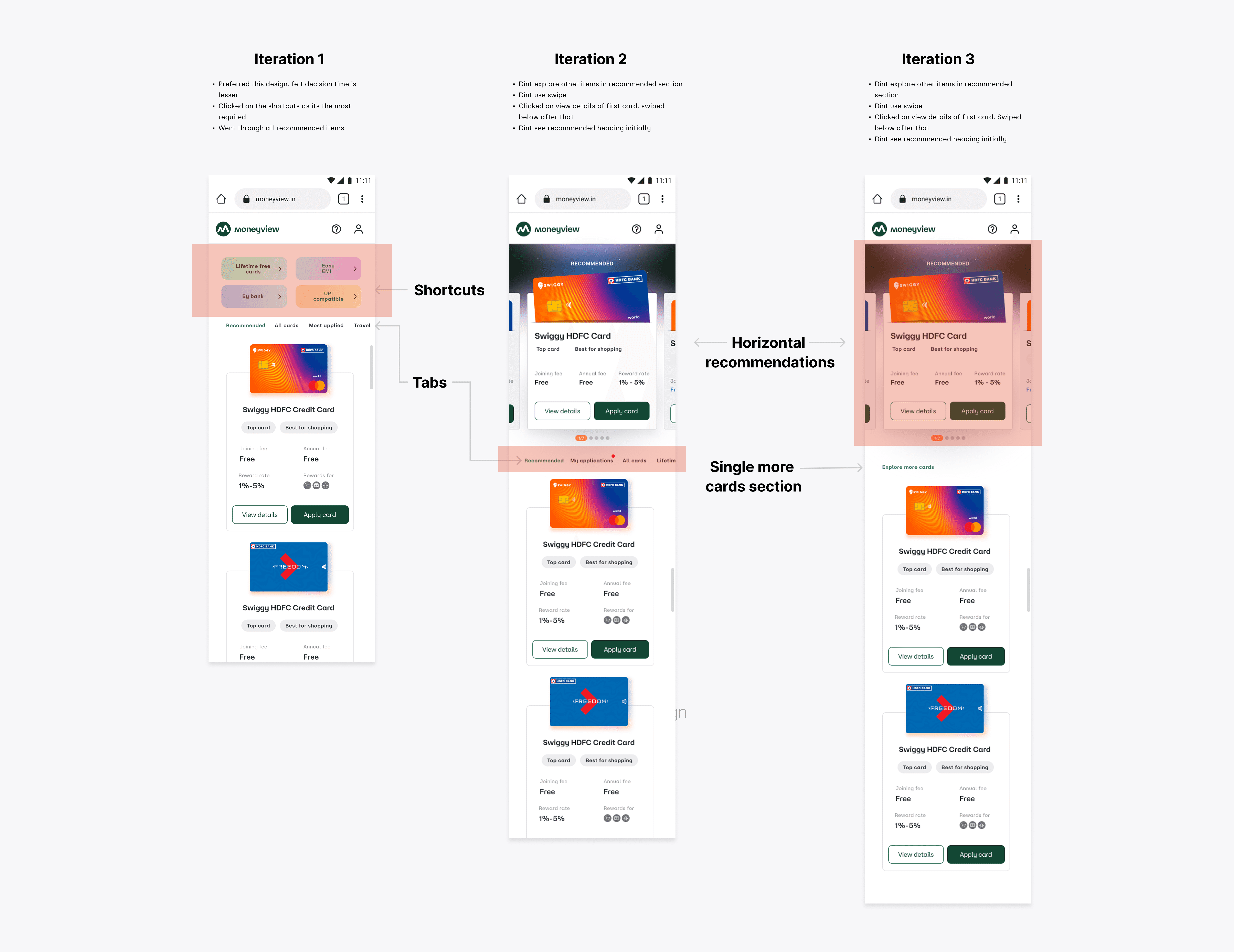

Through iterative card component design, we learned that user-centered design isn't about showing everything—it's about showing the right things at the right moment.

Primary motivations emerged clearly: online shopping (63%), emergency expenses (62%), and major purchases (55%). Application abandonment stemmed from rejection anxiety (105 users) and process complexity (59 users).

Through iterative card component design, we learned that user-centered design isn't about showing everything—it's about showing the right things at the right moment.

/ THE JOURNEY

/ THE JOURNEY

Learning Through Iteration

Learning Through Iteration

DISCOVERY PHASE:

DISCOVERY PHASE:

Our research revealed something profound—users with income above 40k were already 50% more likely to have credit cards. This wasn't just about conversion; it was about democratizing financial access through better design.

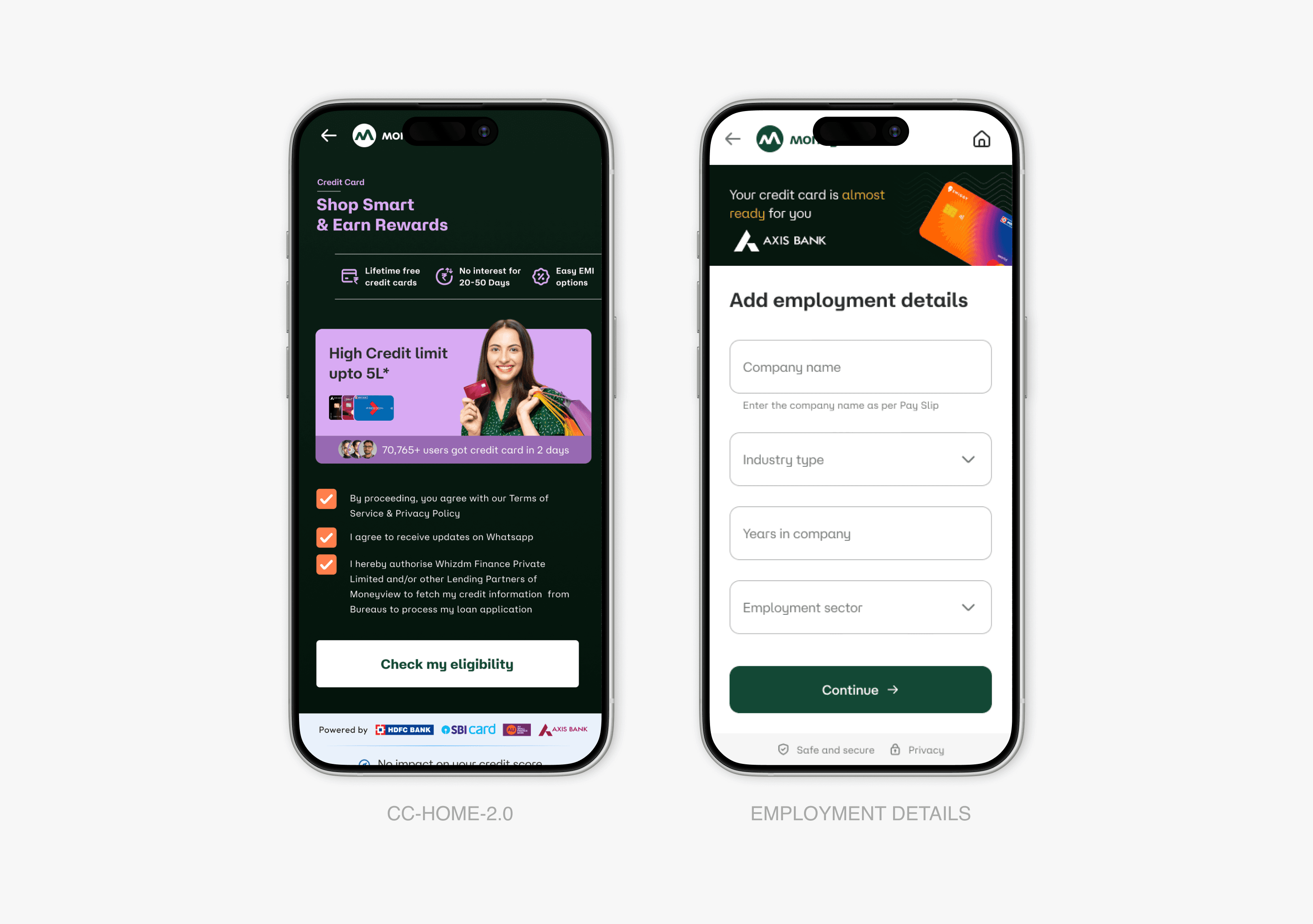

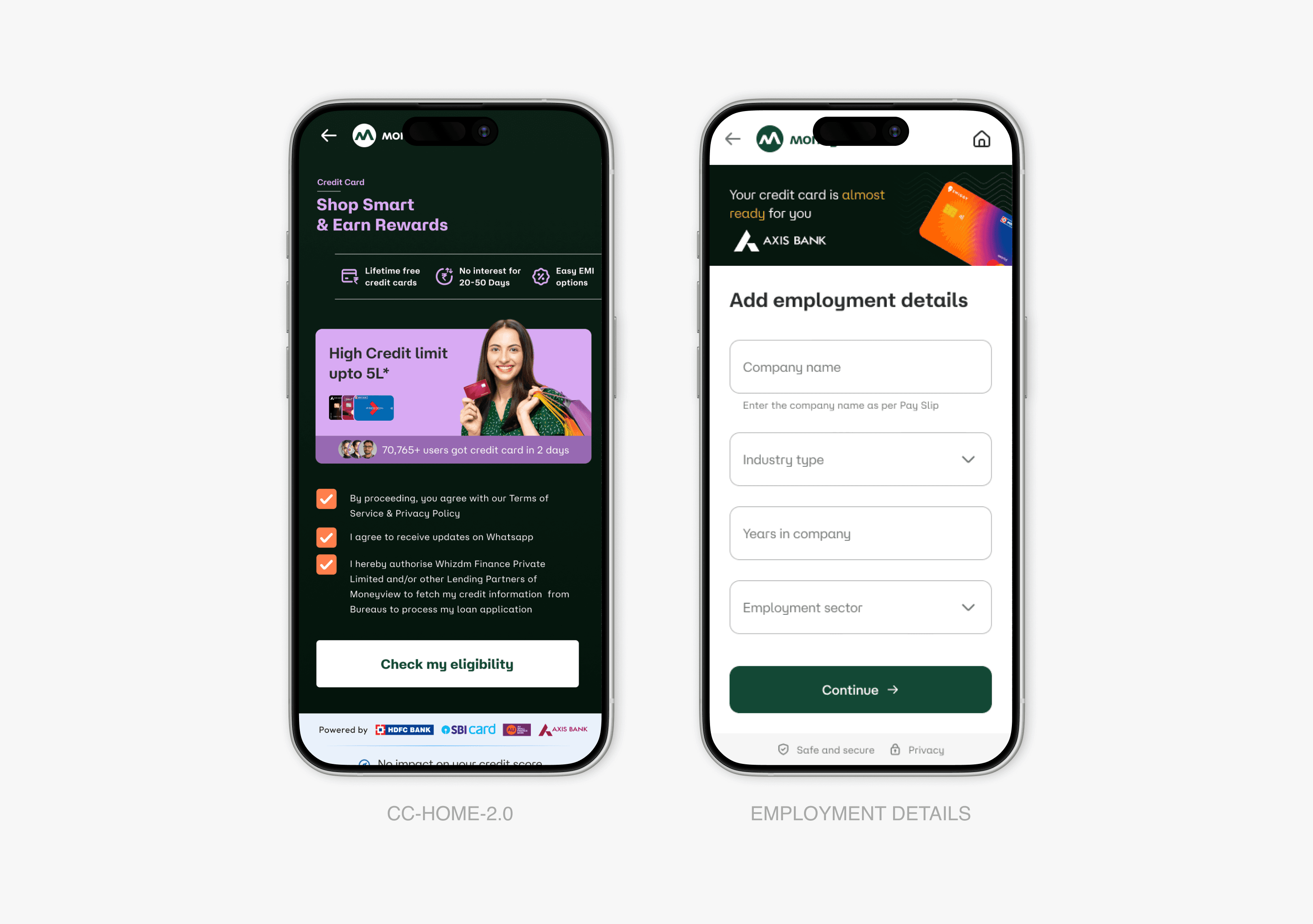

/VERSION-2 /MAY 2025 /QUICK FIXES: HIGH IMPACT, LOW EFFORTS

/VERSION-2 /MAY 2025 /QUICK FIXES: HIGH IMPACT, LOW EFFORTS

Immediate Relief for Critical Pain Points

Immediate Relief for Critical Pain Points

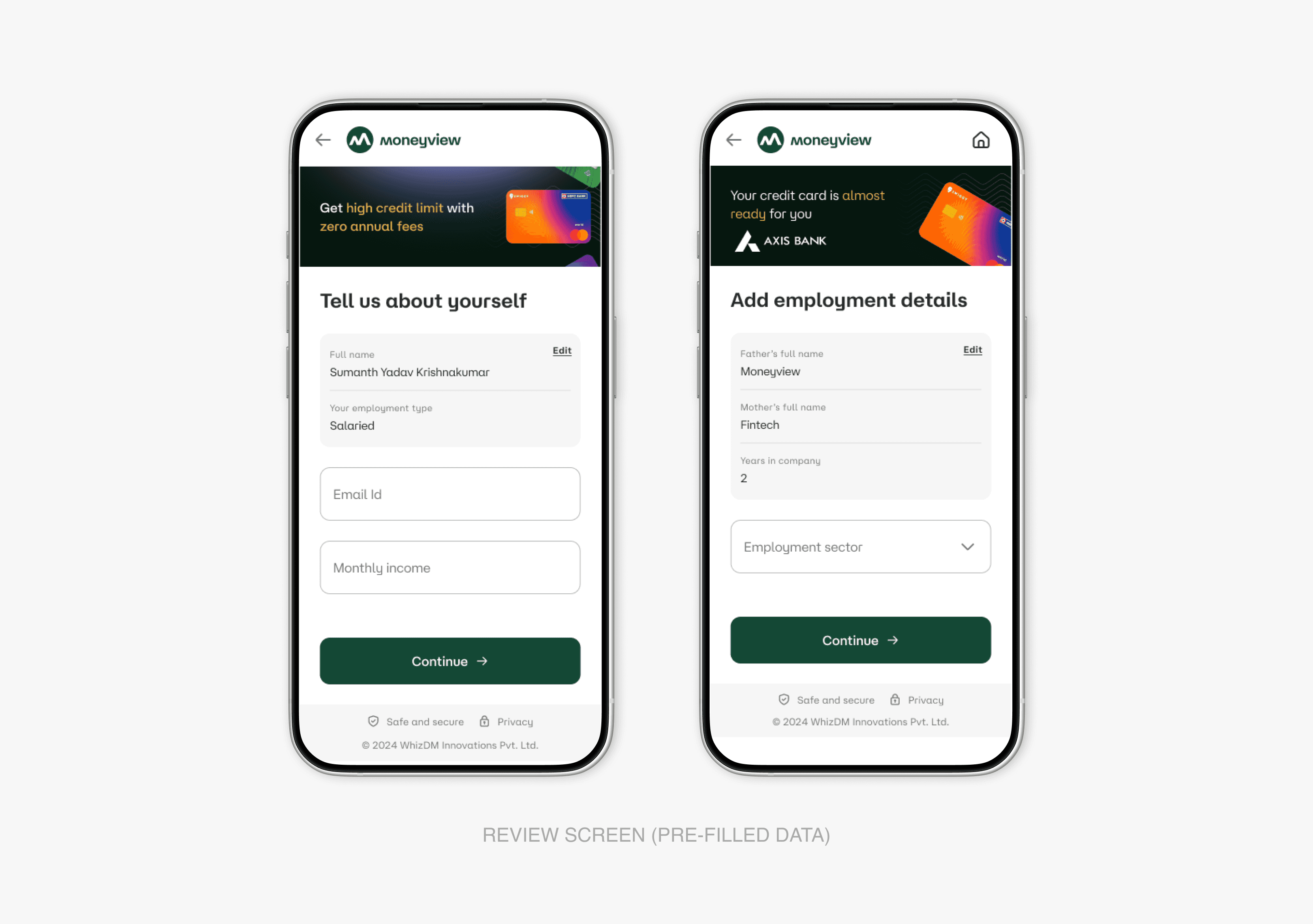

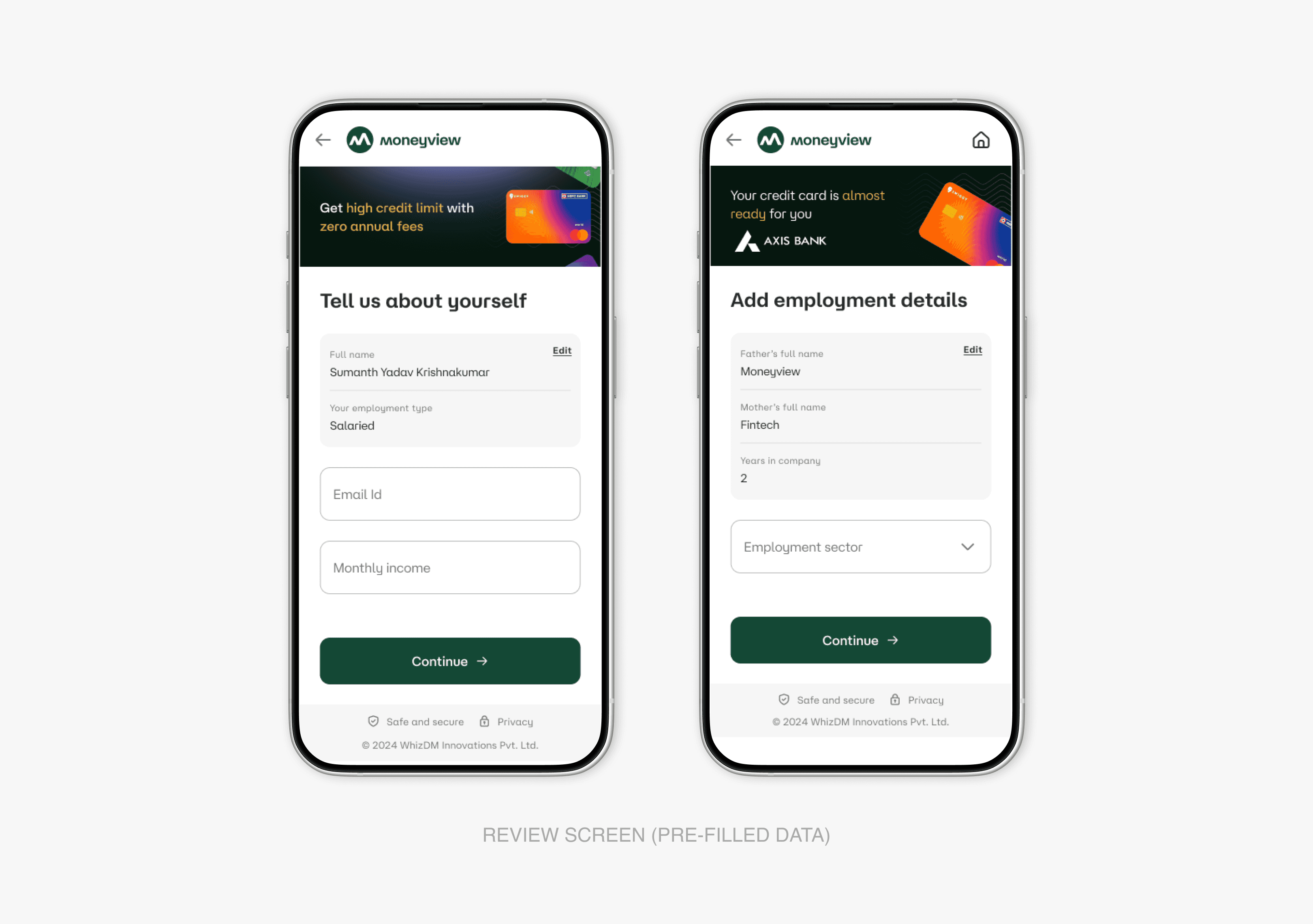

Before diving into comprehensive redesign, we identified quick wins that could provide immediate user relief:

Before diving into comprehensive redesign, we identified quick wins that could provide immediate user relief:

Form Simplification:

Form Simplification:

Implemented progressive disclosure for secondary information

Reduced entry barriers from 18 fields to 6 essential fields

Added smart defaults and auto-complete functionality

Landing Screen Decluttering:

Landing Screen Decluttering:

Removed 60% of redundant content elements

Established clear visual hierarchy with primary and secondary actions

Introduced focused value proposition messaging

Removed 60% of redundant content elements

Established clear visual hierarchy with primary and secondary actions

Introduced focused value proposition messaging

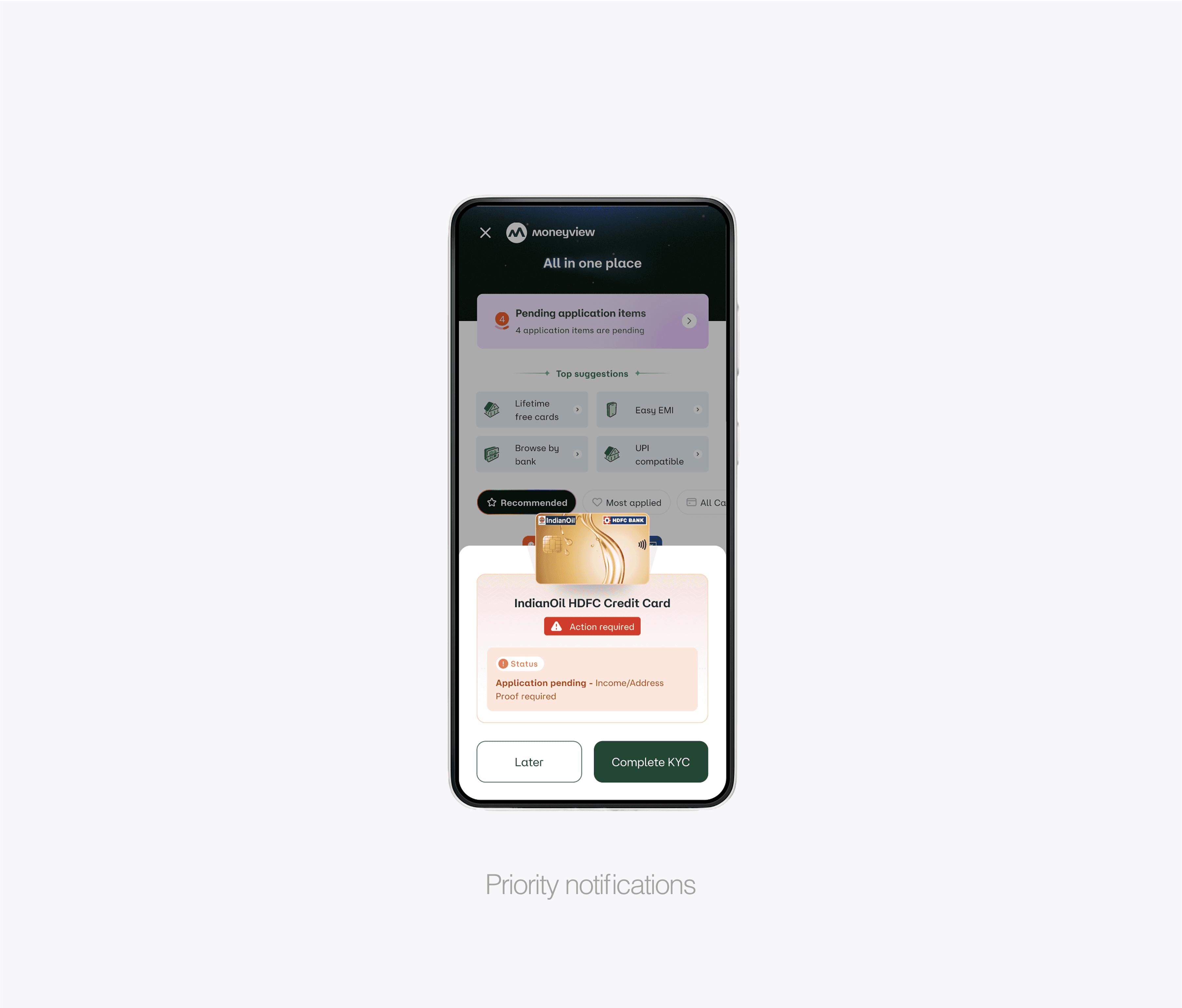

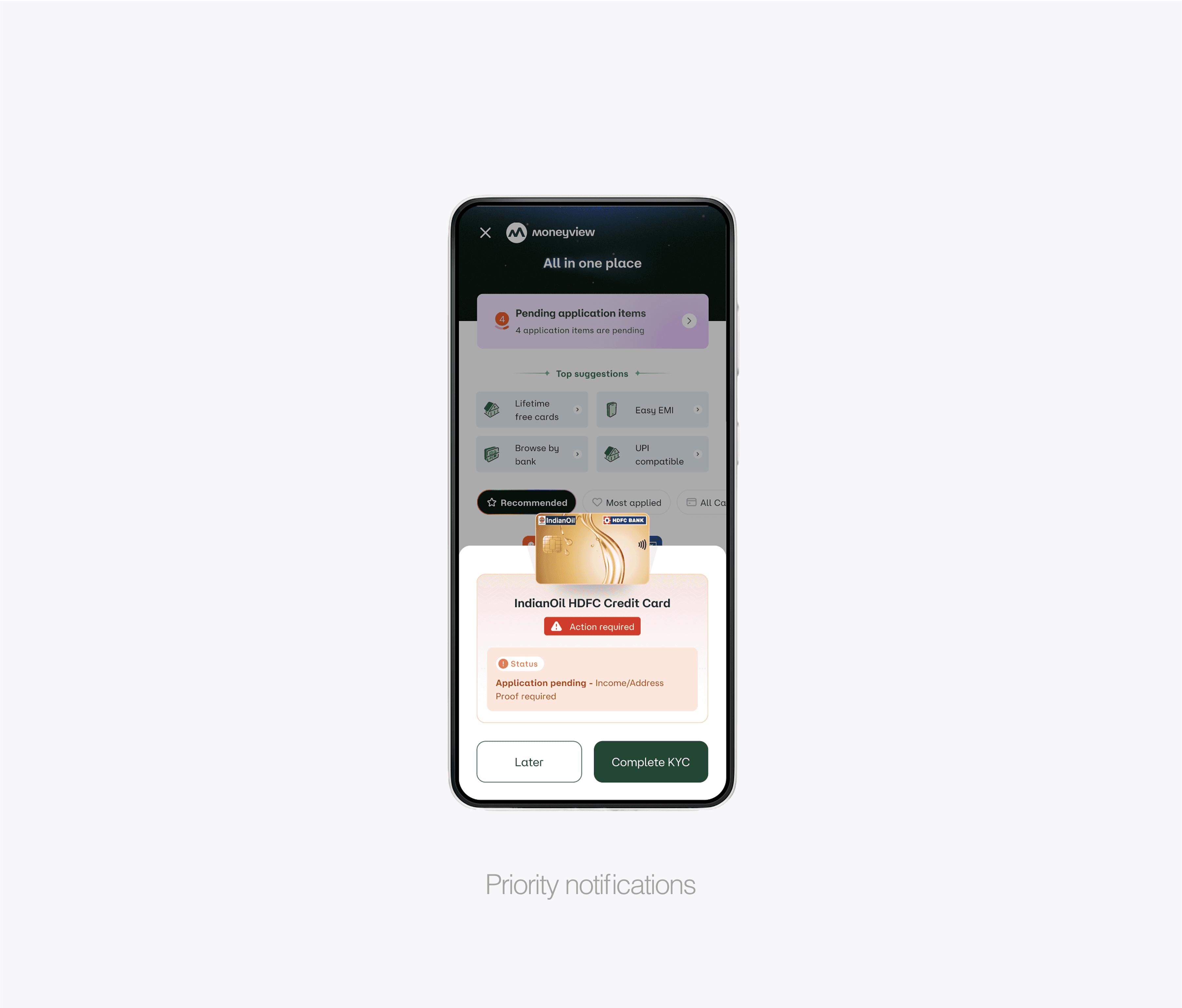

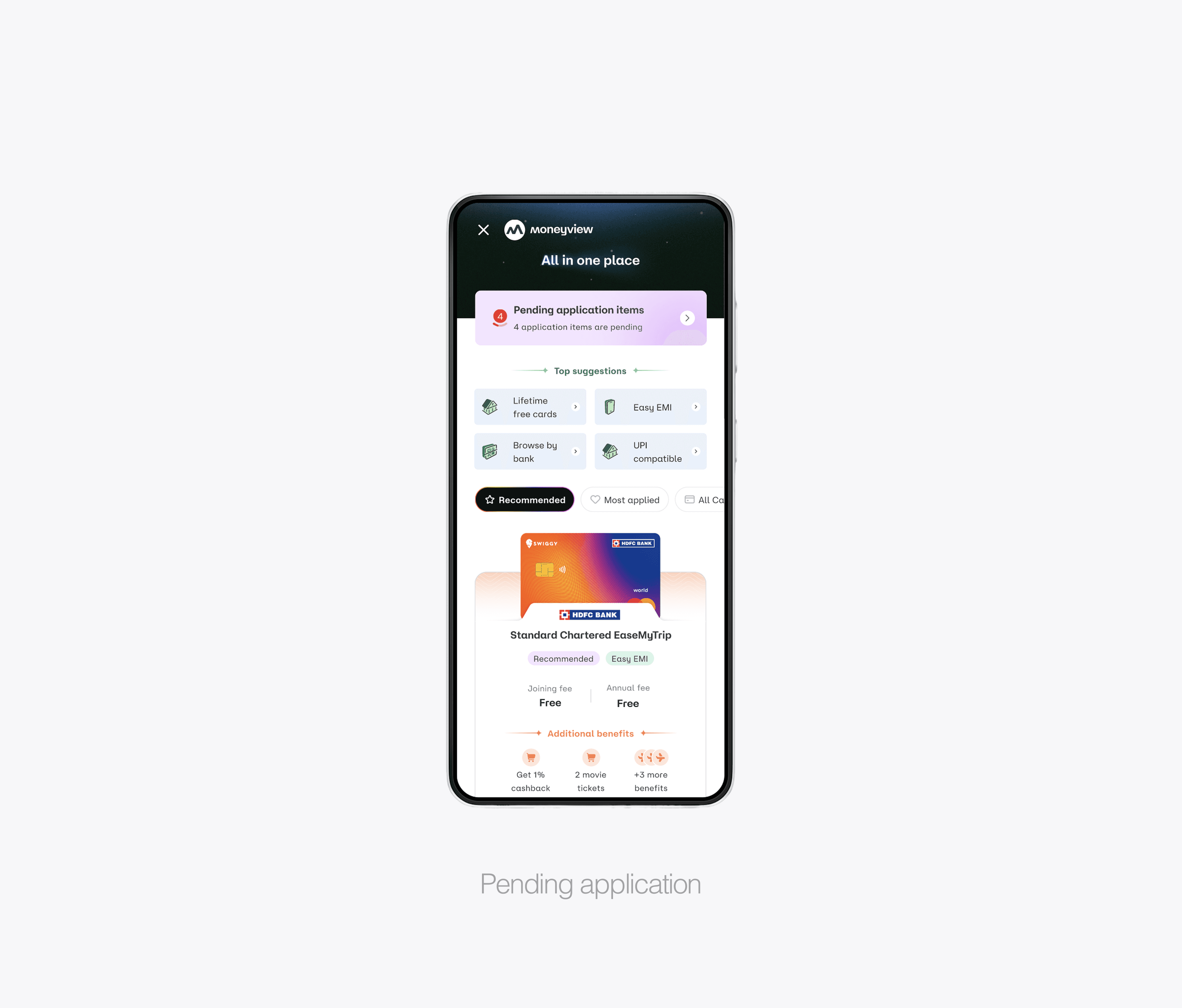

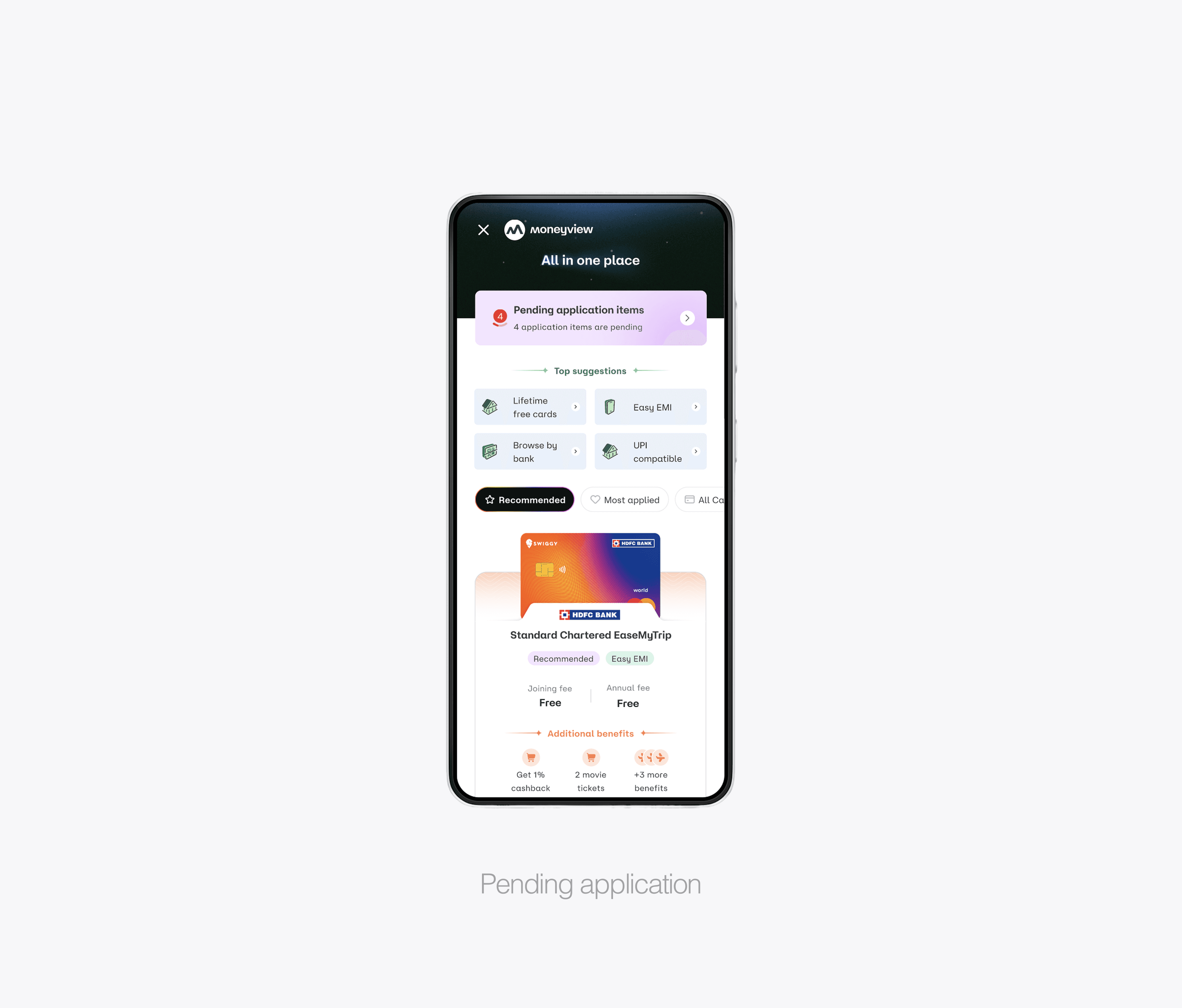

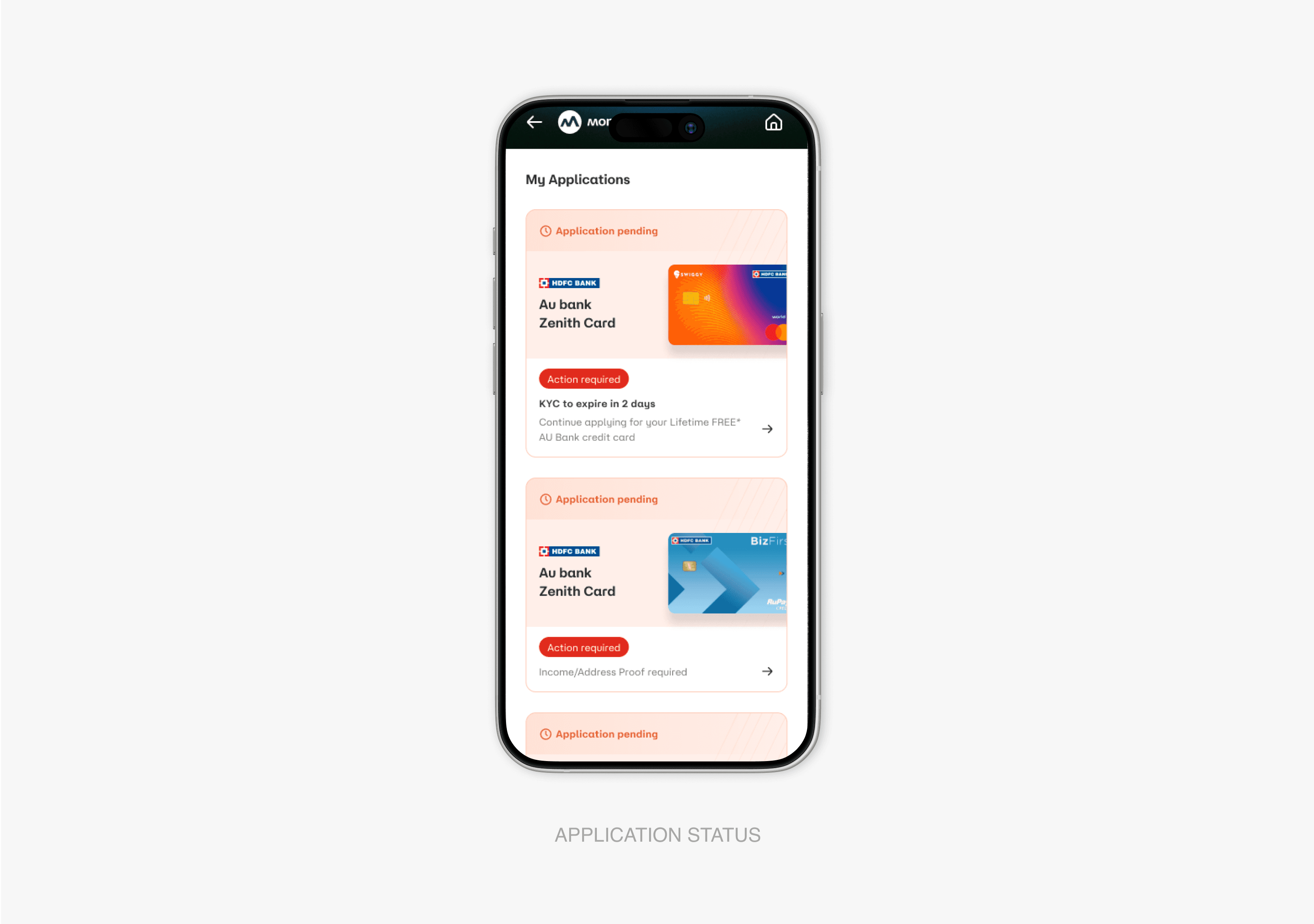

Application Integration:

Application Integration:

Merged pending applications directly into main discovery flow

Added priority notifications for applications requiring action

Created seamless transition between application states

Merged pending applications directly into main discovery flow

Added priority notifications for applications requiring action

Created seamless transition between application states

Personal Insight: These quick fixes taught me that sometimes the biggest impact comes from removing complexity rather than adding features. Users immediately felt more confident navigating the simplified interface.

Personal Insight: These quick fixes taught me that sometimes the biggest impact comes from removing complexity rather than adding features. Users immediately felt more confident navigating the simplified interface.

/ VERSION-2 /JUN 2025 /THE COMPLETE REVAMP

/ VERSION-2 /JUN 2025 /THE COMPLETE REVAMP

Reimagining the Entire Discovery Architecture

Reimagining the Entire Discovery Architecture

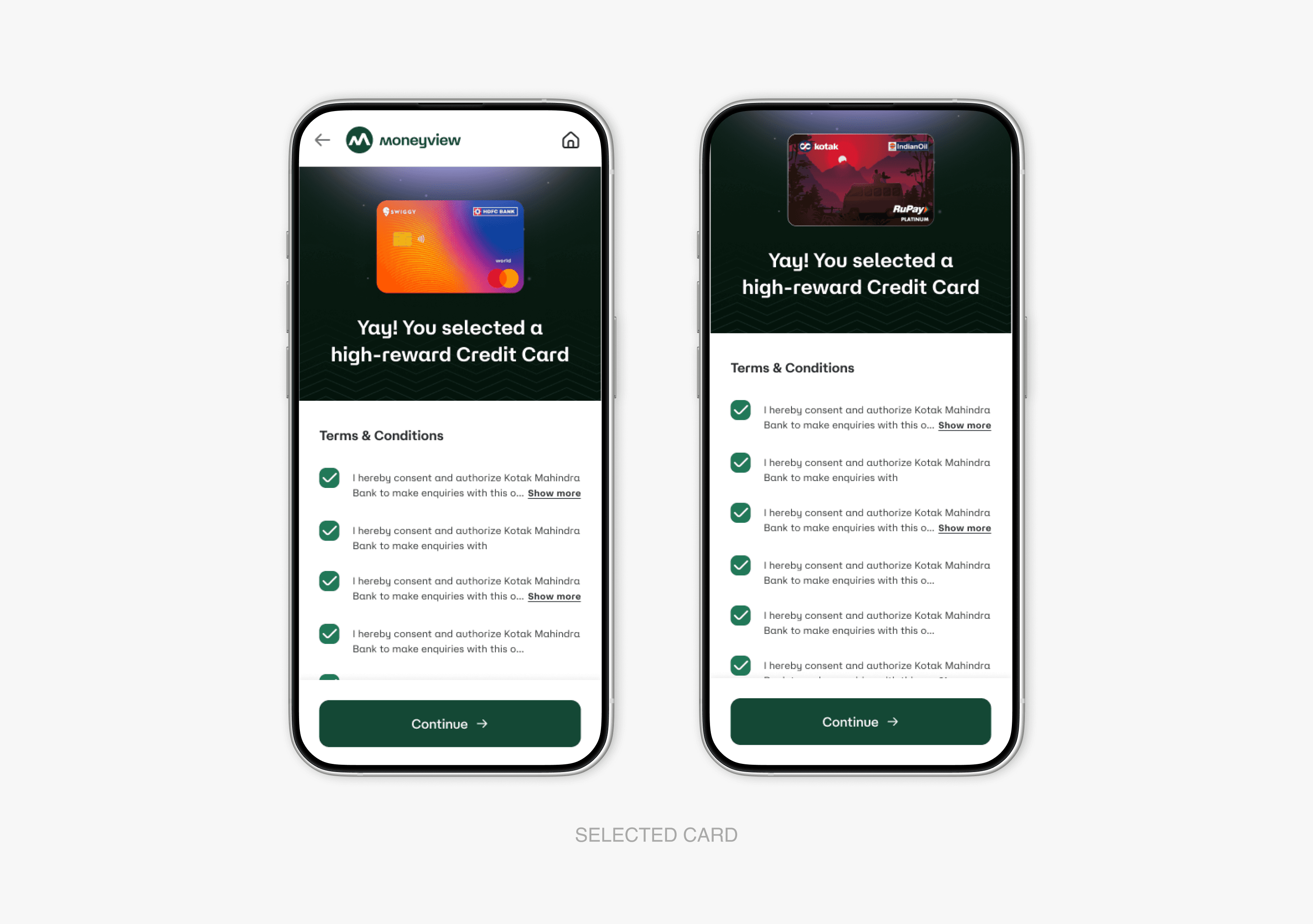

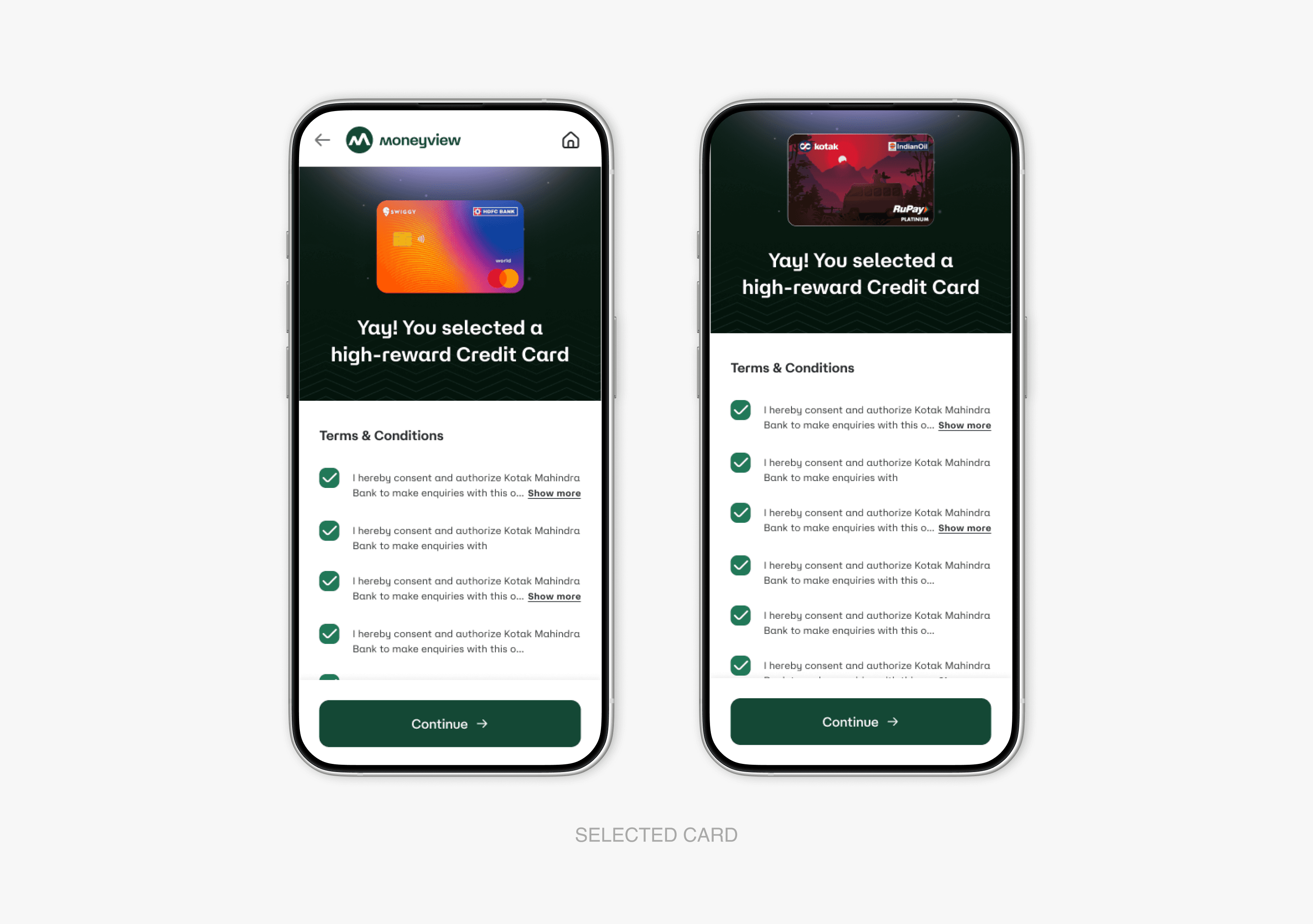

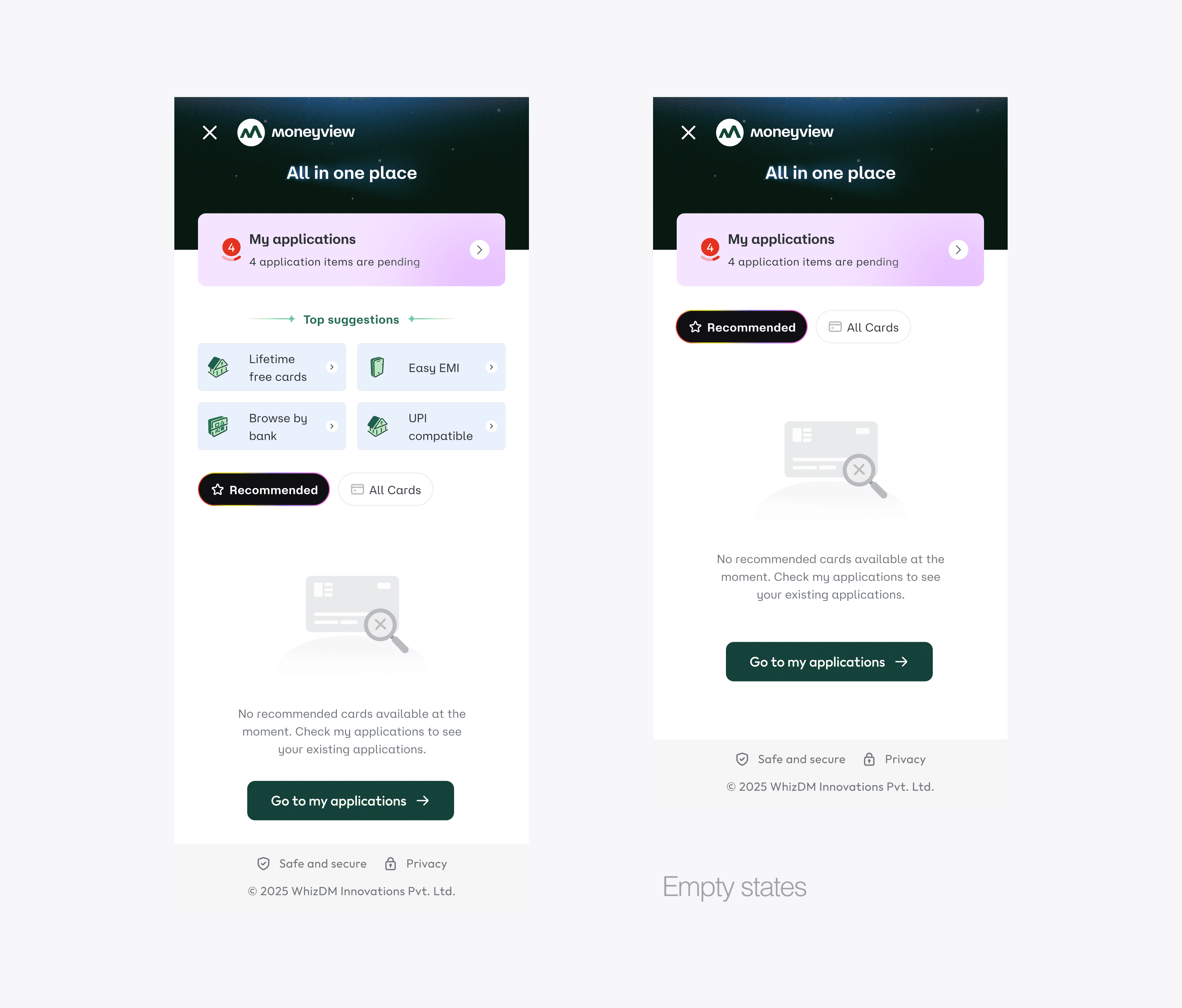

After validating our initial improvements, we embarked on a comprehensive redesign that fundamentally transformed how users interact with financial applications and card discovery.

After validating our initial improvements, we embarked on a comprehensive redesign that fundamentally transformed how users interact with financial applications and card discovery.

Strategic Interface Evolution

Strategic Interface Evolution

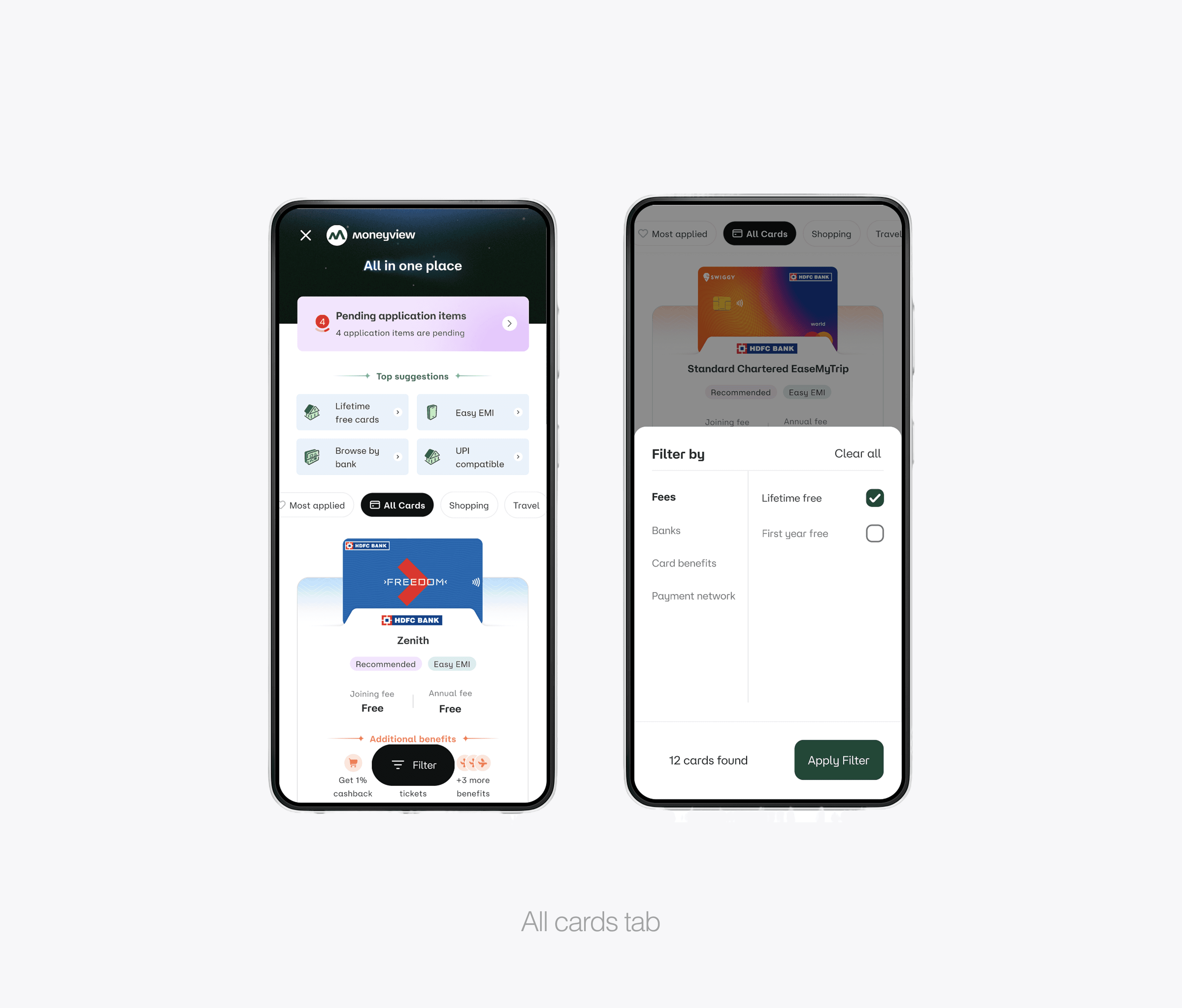

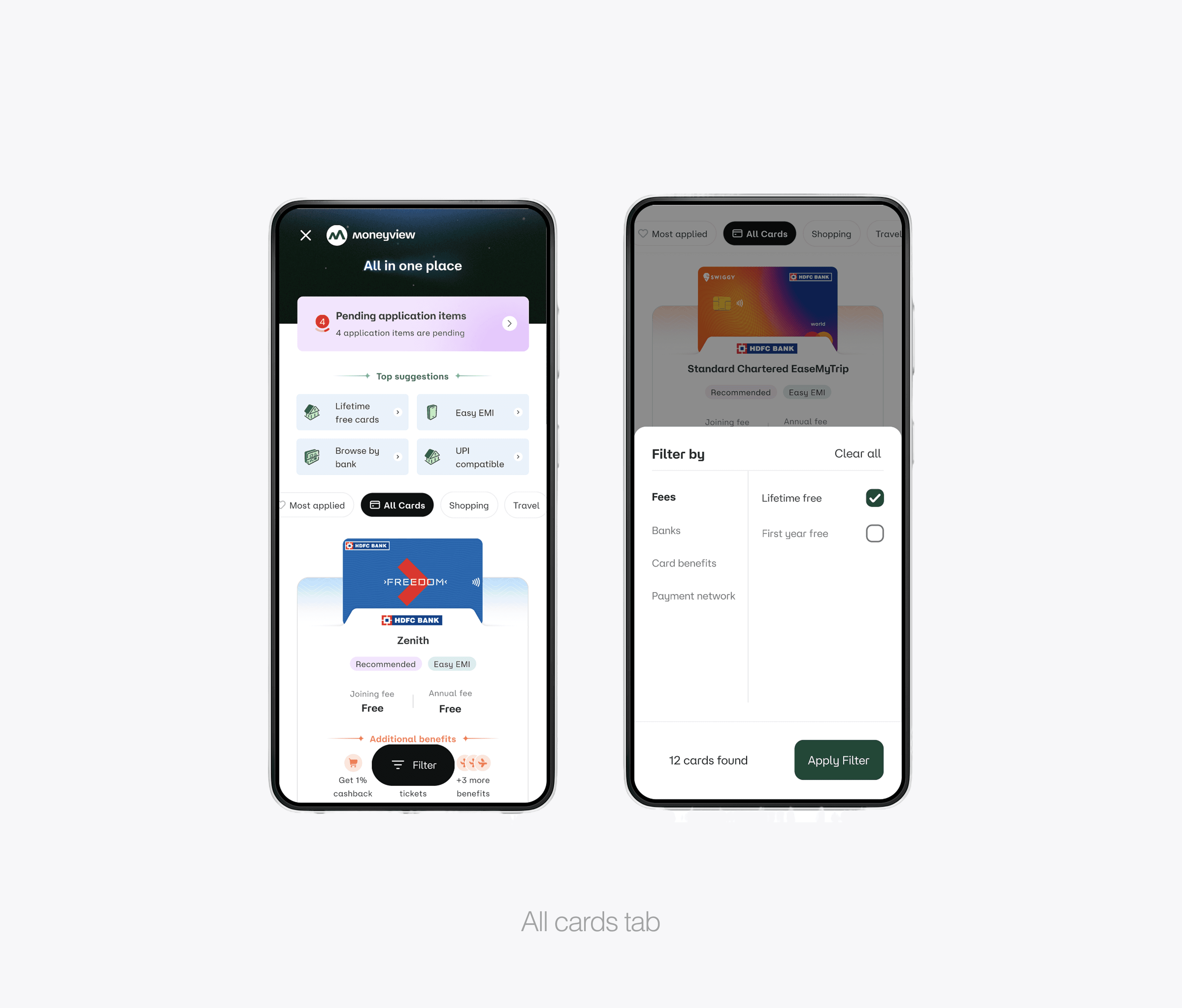

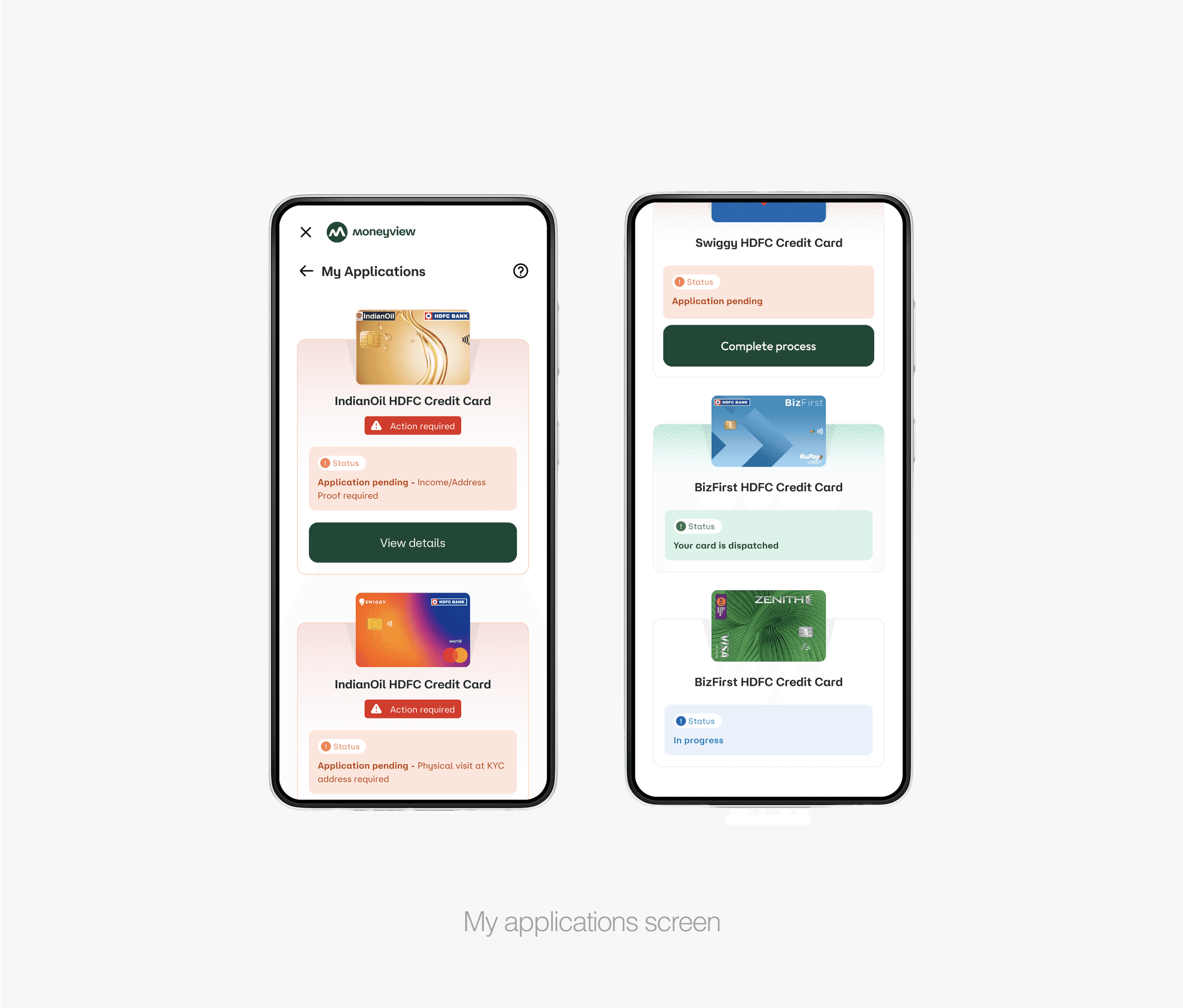

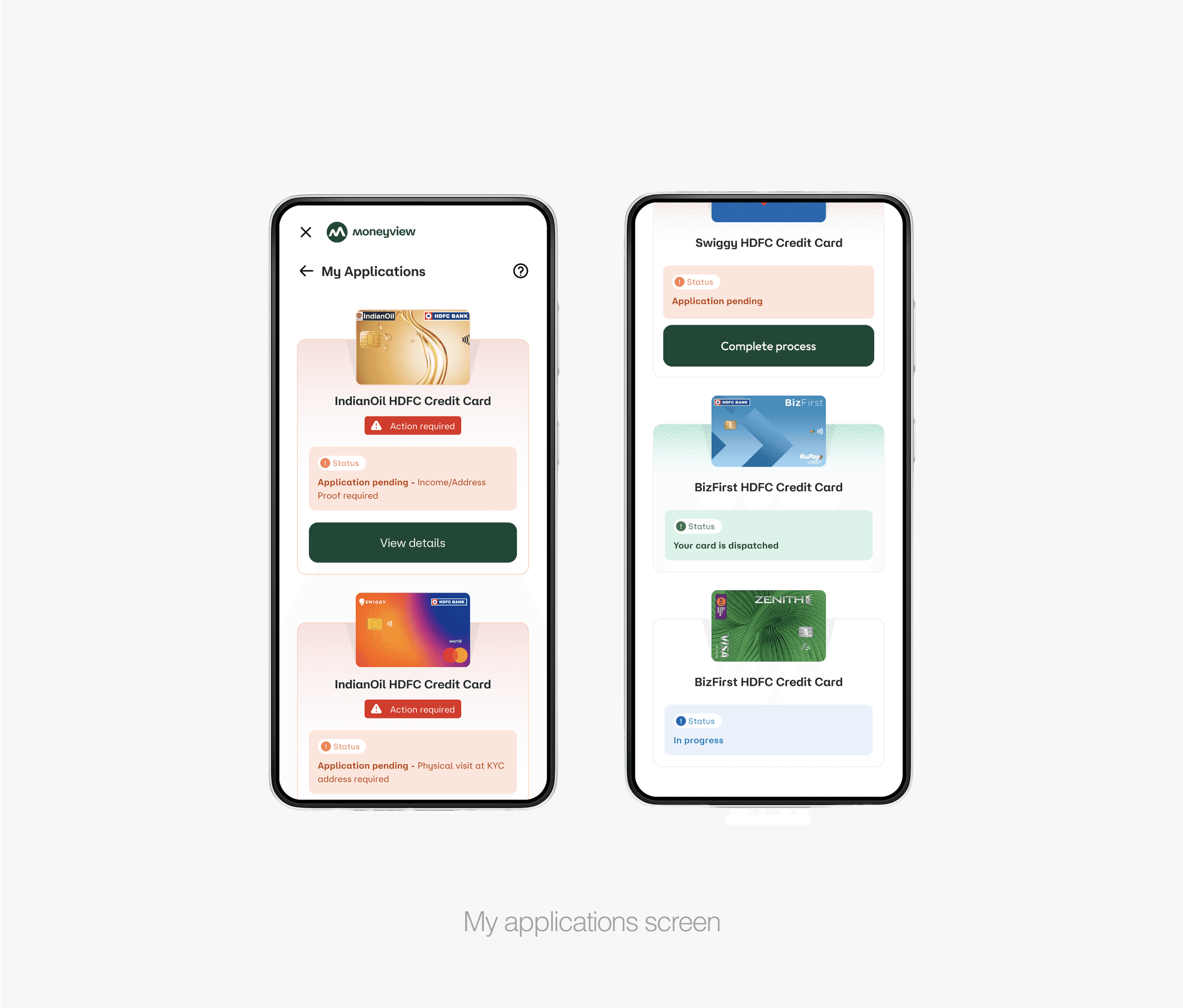

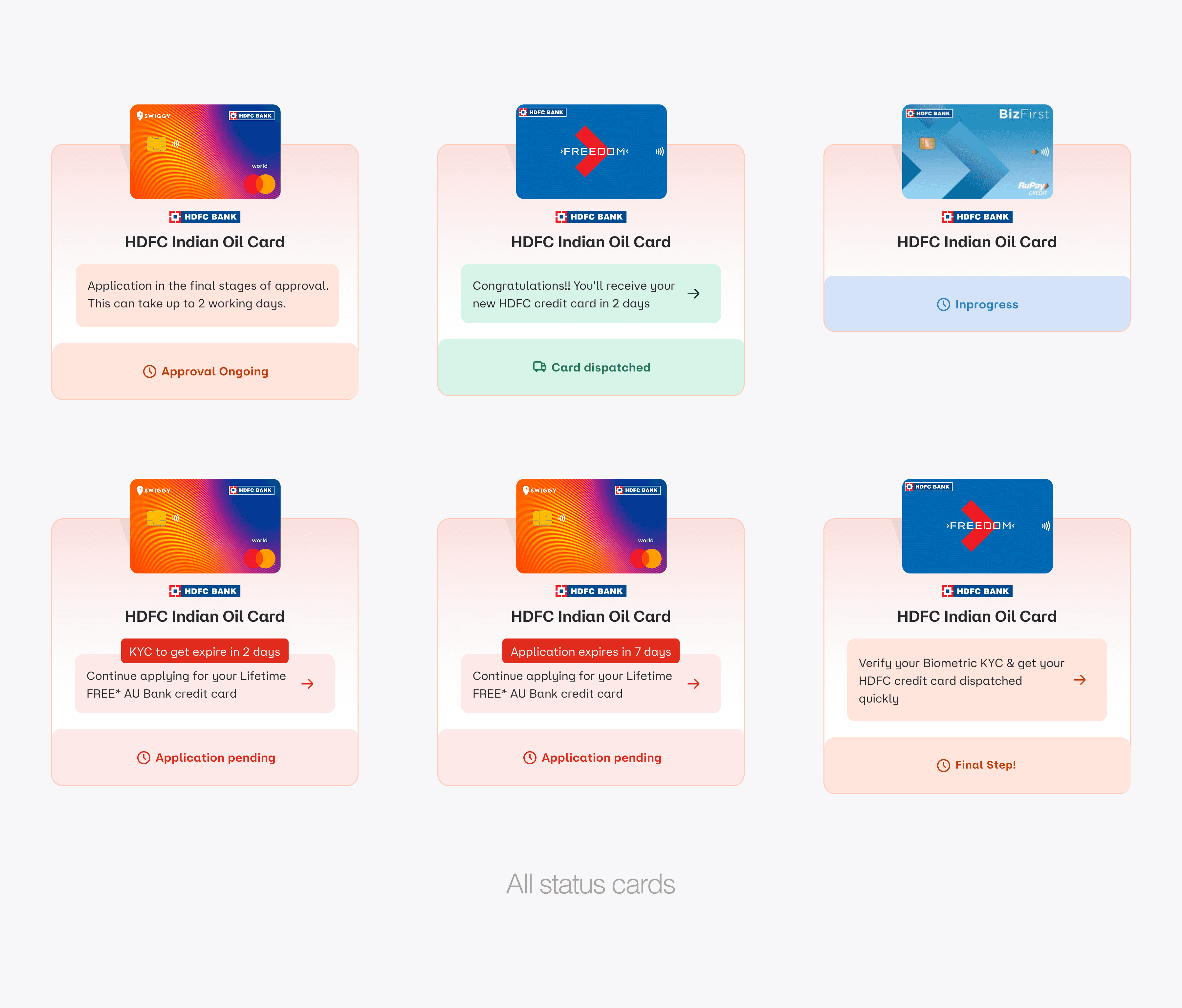

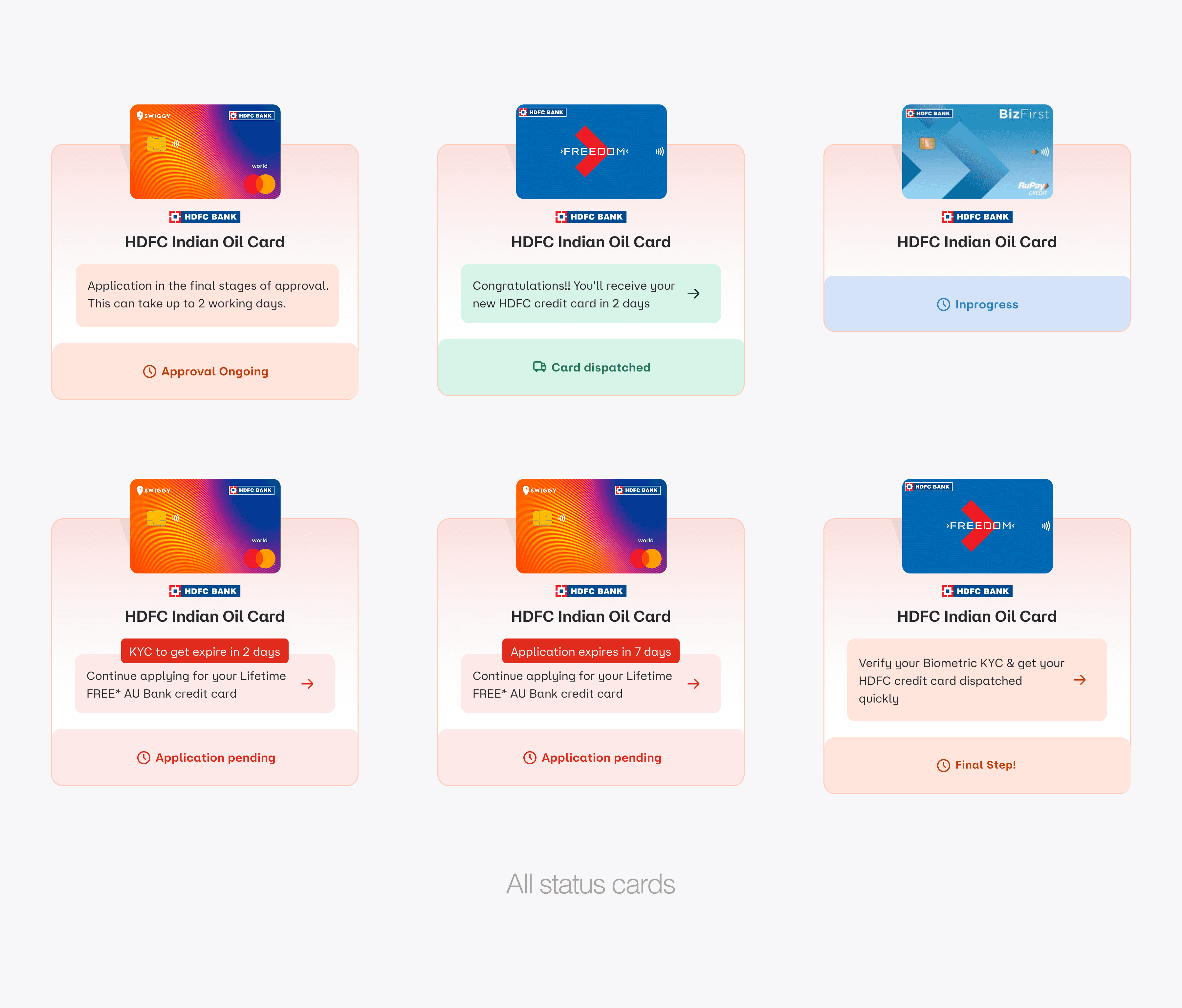

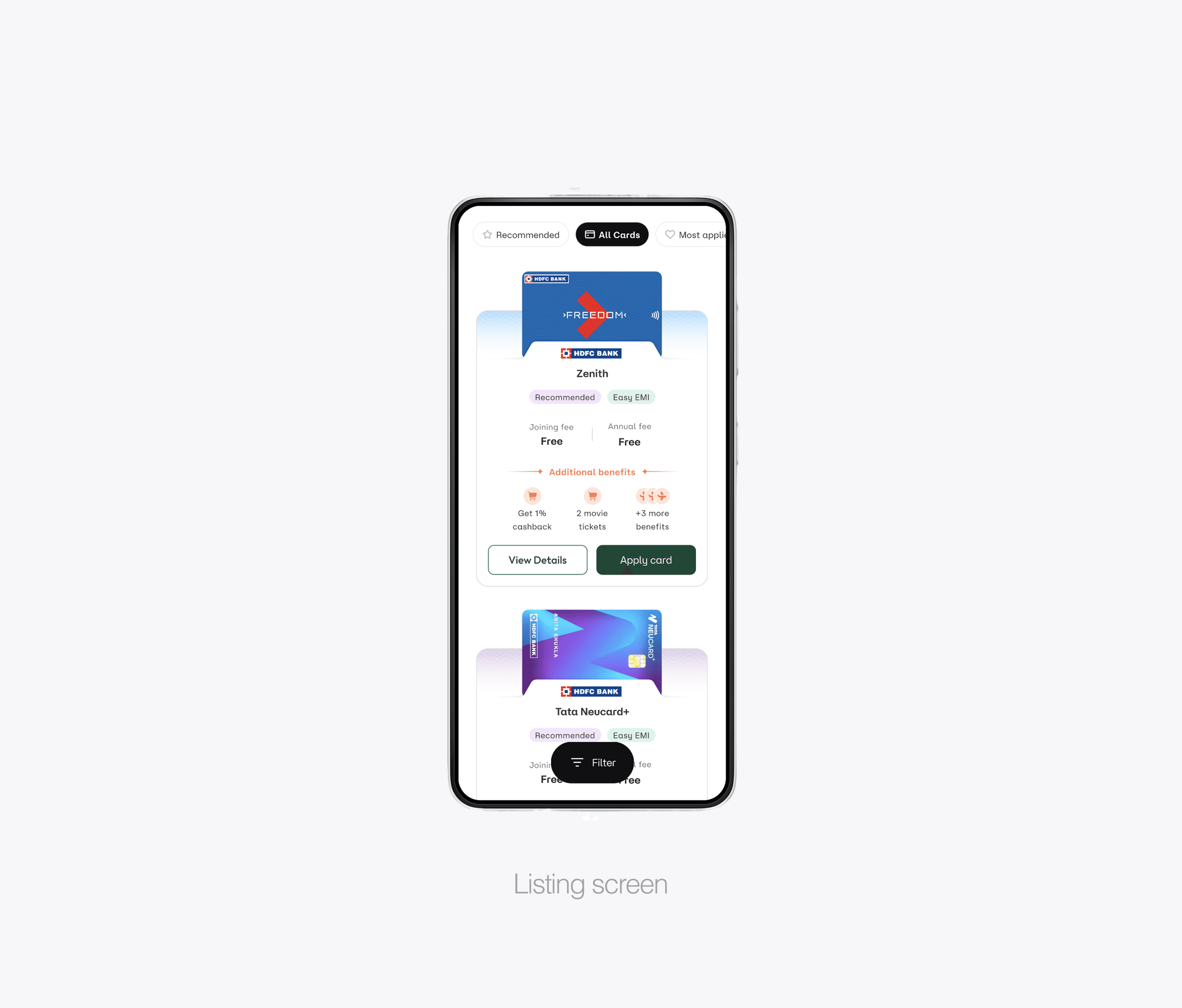

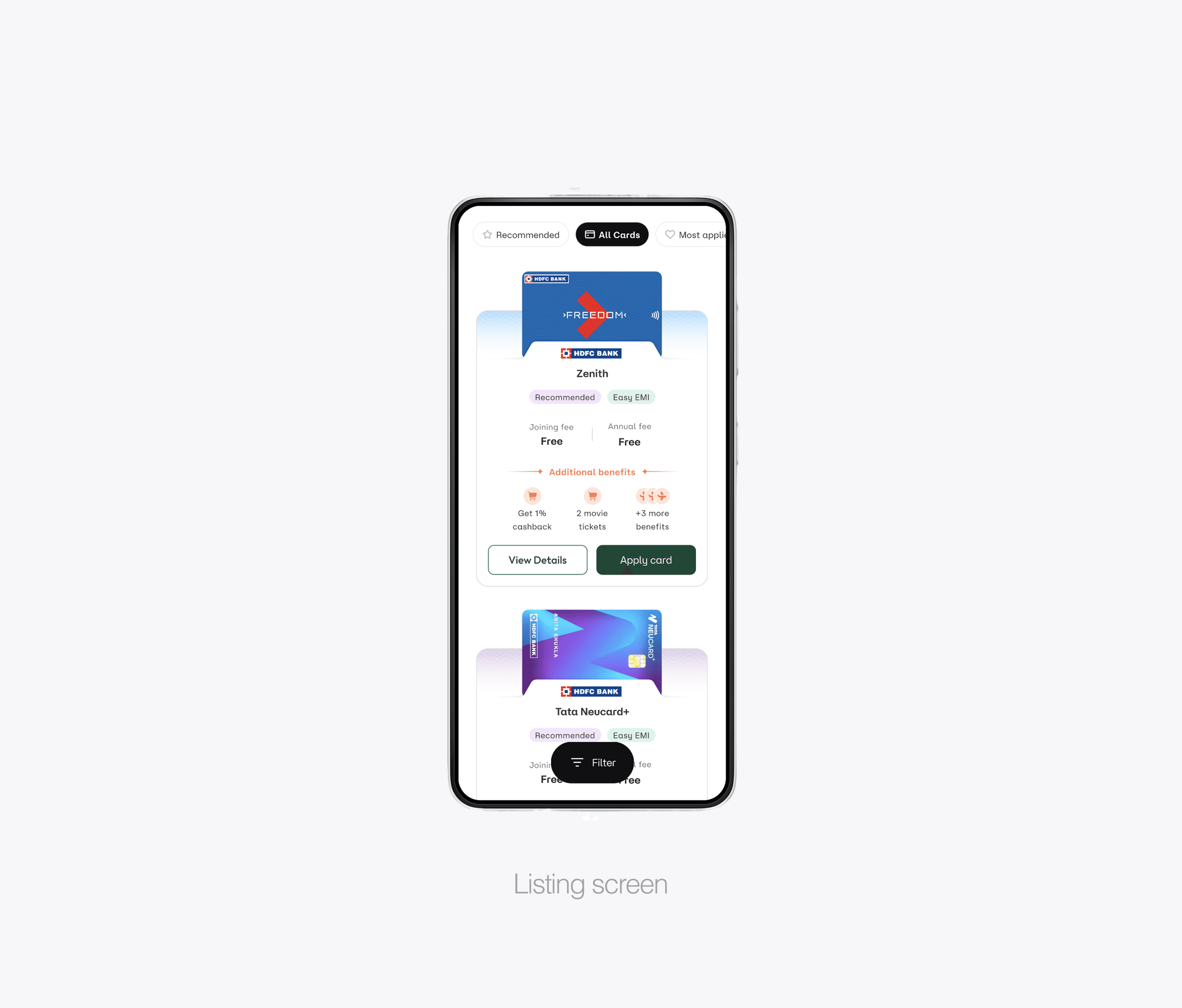

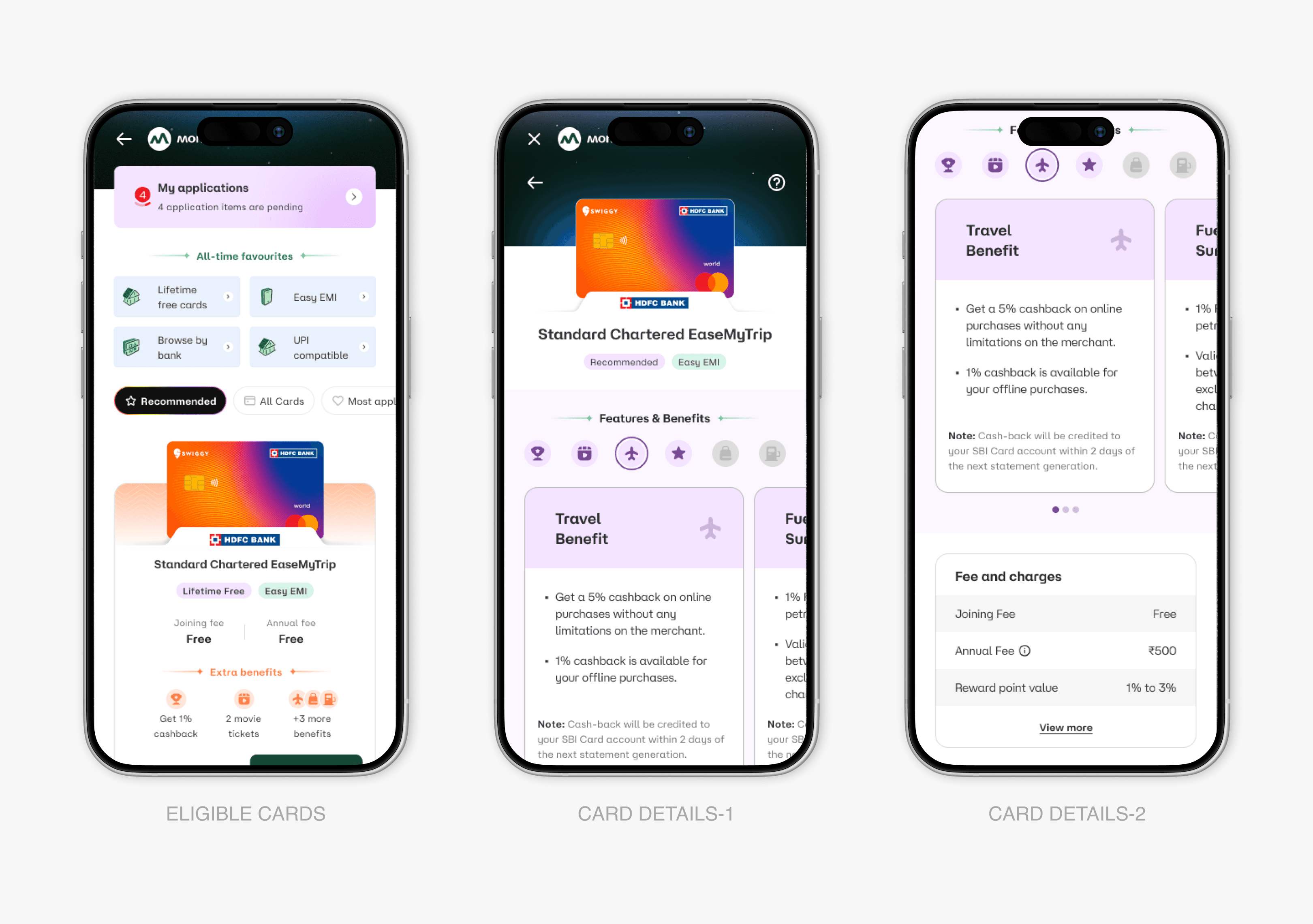

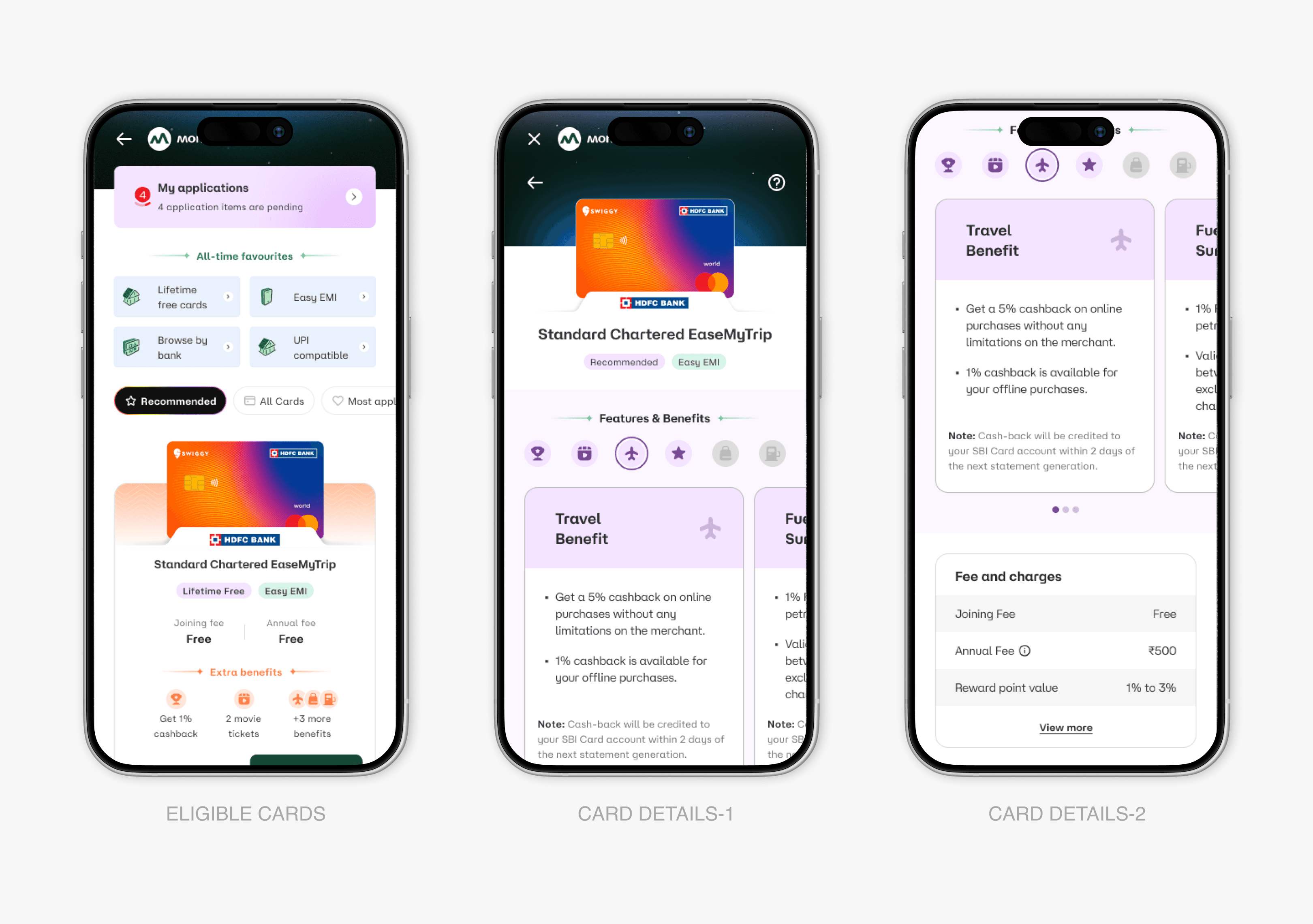

Tabbed Navigation System We introduced a sophisticated three-tab structure:

My Applications: Centralized hub featuring priority notifications, real-time status updates, and intuitive timeline progression

All Cards: Comprehensive discovery experience with intelligent recommendations and contextual filtering

Filter Screen: Dedicated filtering interface with advanced categorization and real-time feedback

Tabbed Navigation System We introduced a sophisticated three-tab structure:

My Applications: Centralized hub featuring priority notifications, real-time status updates, and intuitive timeline progression

All Cards: Comprehensive discovery experience with intelligent recommendations and contextual filtering

Filter Screen: Dedicated filtering interface with advanced categorization and real-time feedback

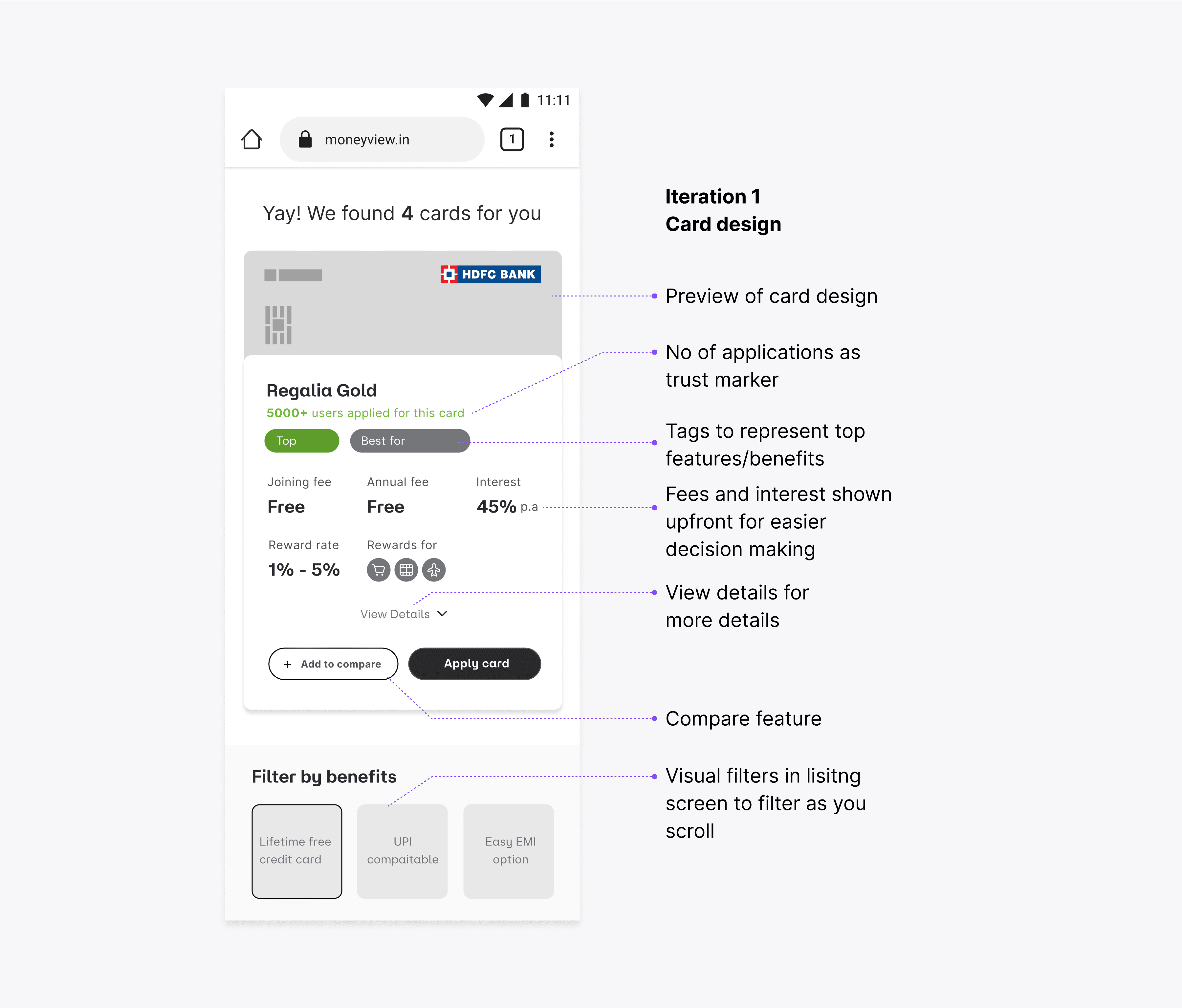

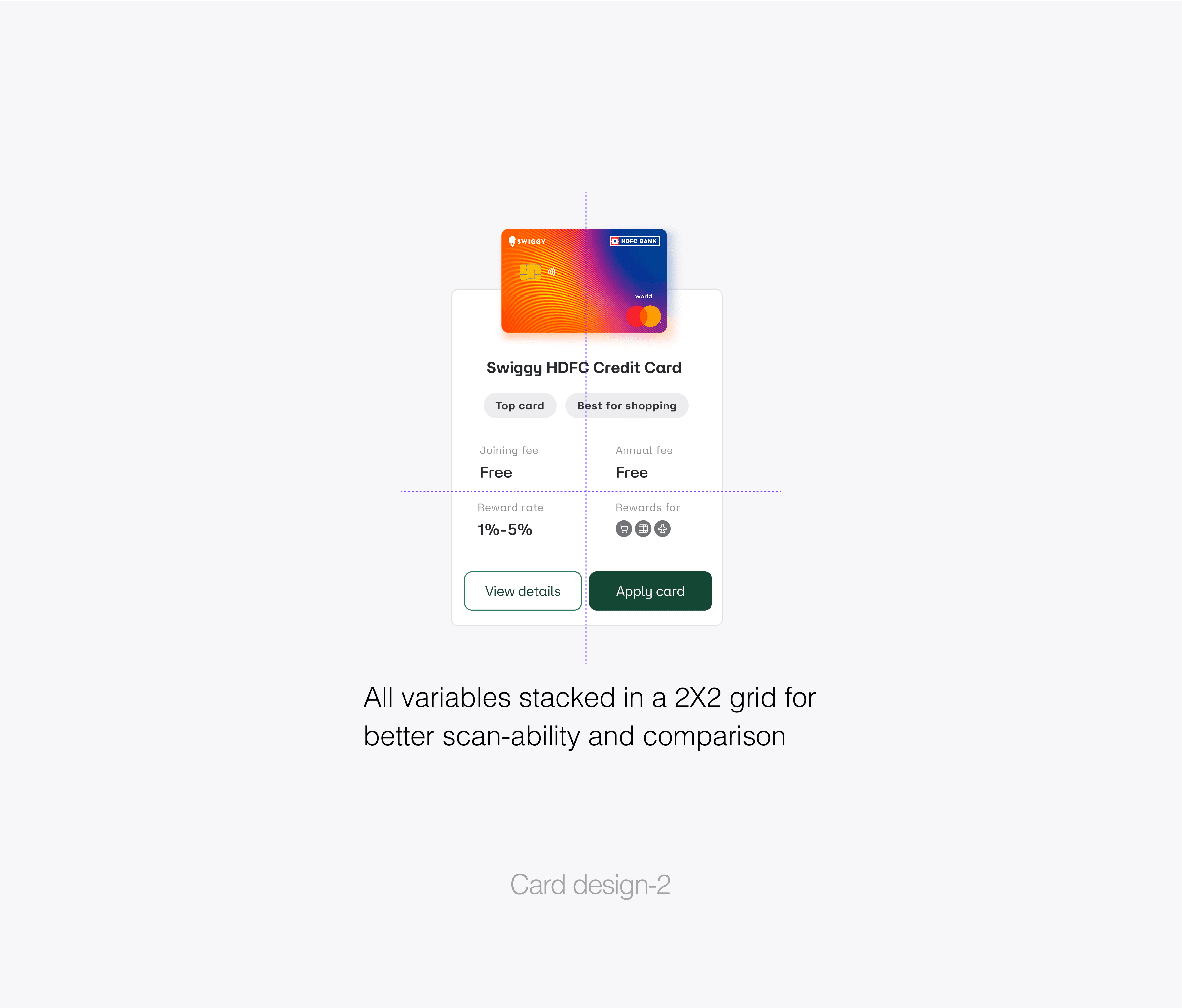

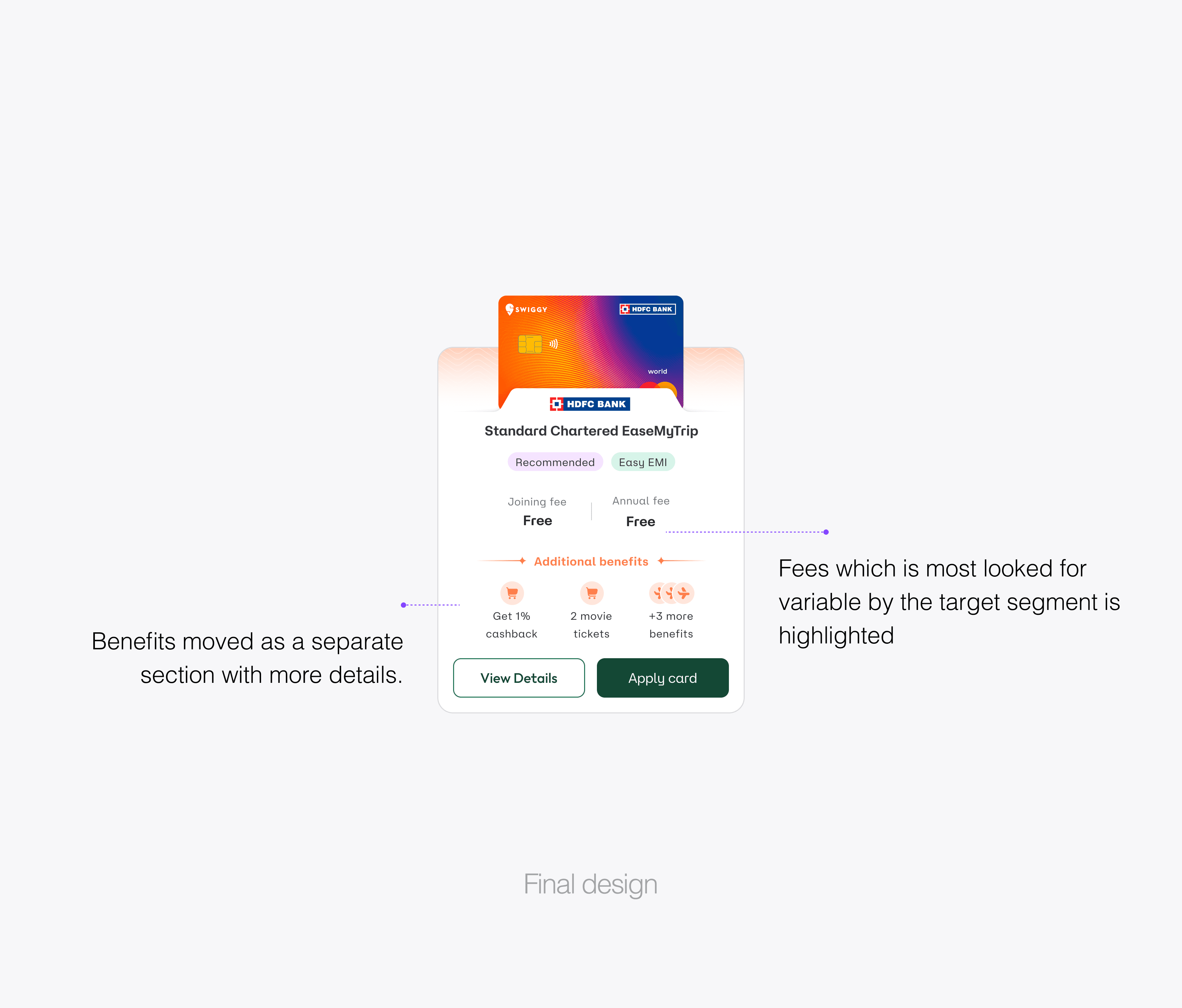

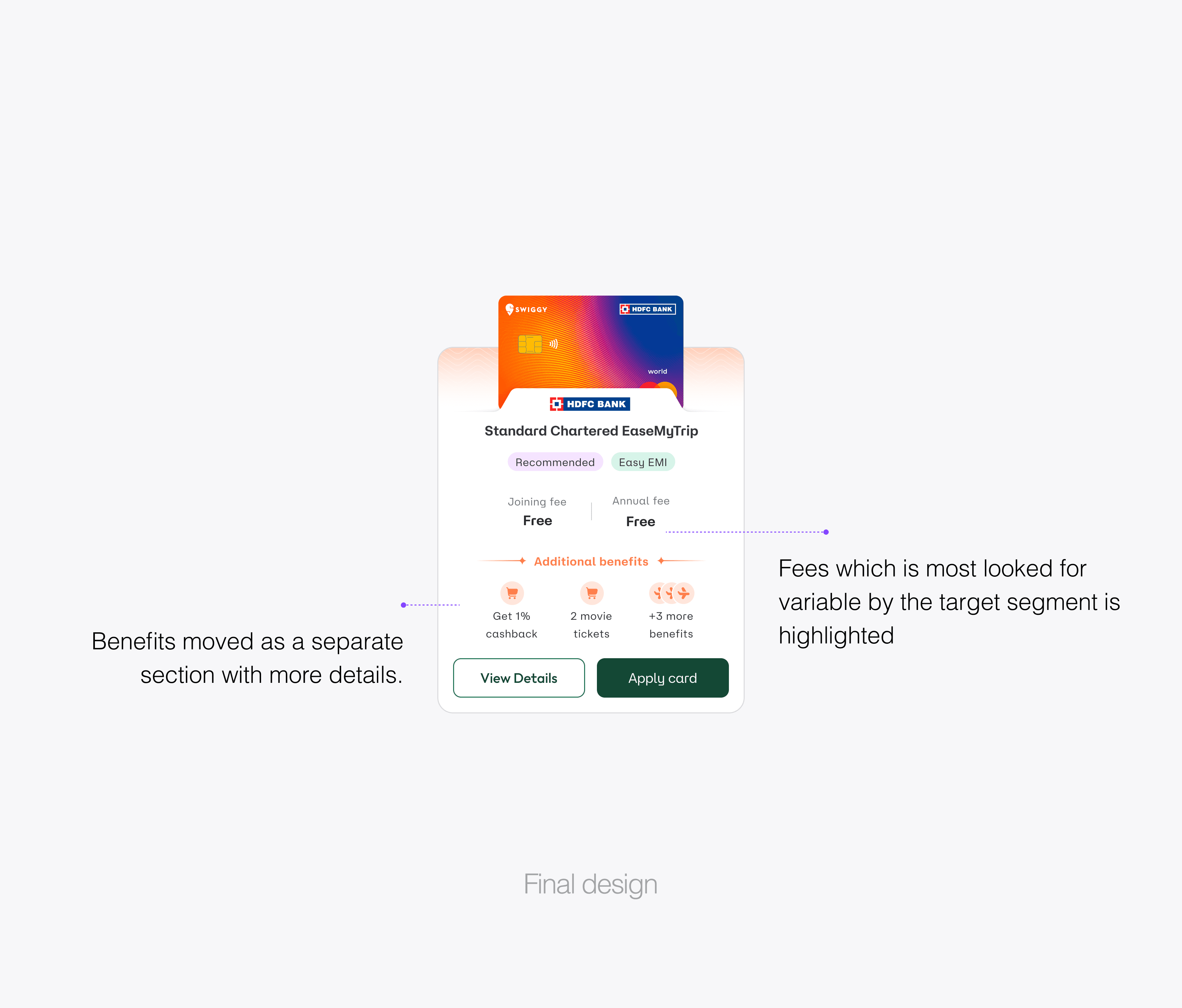

Card Component Transformation

Card Component Transformation

Through iterative design validation, we discovered that users needed strategic information hierarchy—separating essential decision-making data from exploratory details. Our card evolution focused on:

Fee Transparency: Clear joining and annual fee visibility

Benefit Previews: Immediate value proposition understanding

Action Clarity: Distinct "View Details" and "Apply Card" pathways

Through iterative design validation, we discovered that users needed strategic information hierarchy—separating essential decision-making data from exploratory details. Our card evolution focused on:

Fee Transparency: Clear joining and annual fee visibility

Benefit Previews: Immediate value proposition understanding

Action Clarity: Distinct "View Details" and "Apply Card" pathways

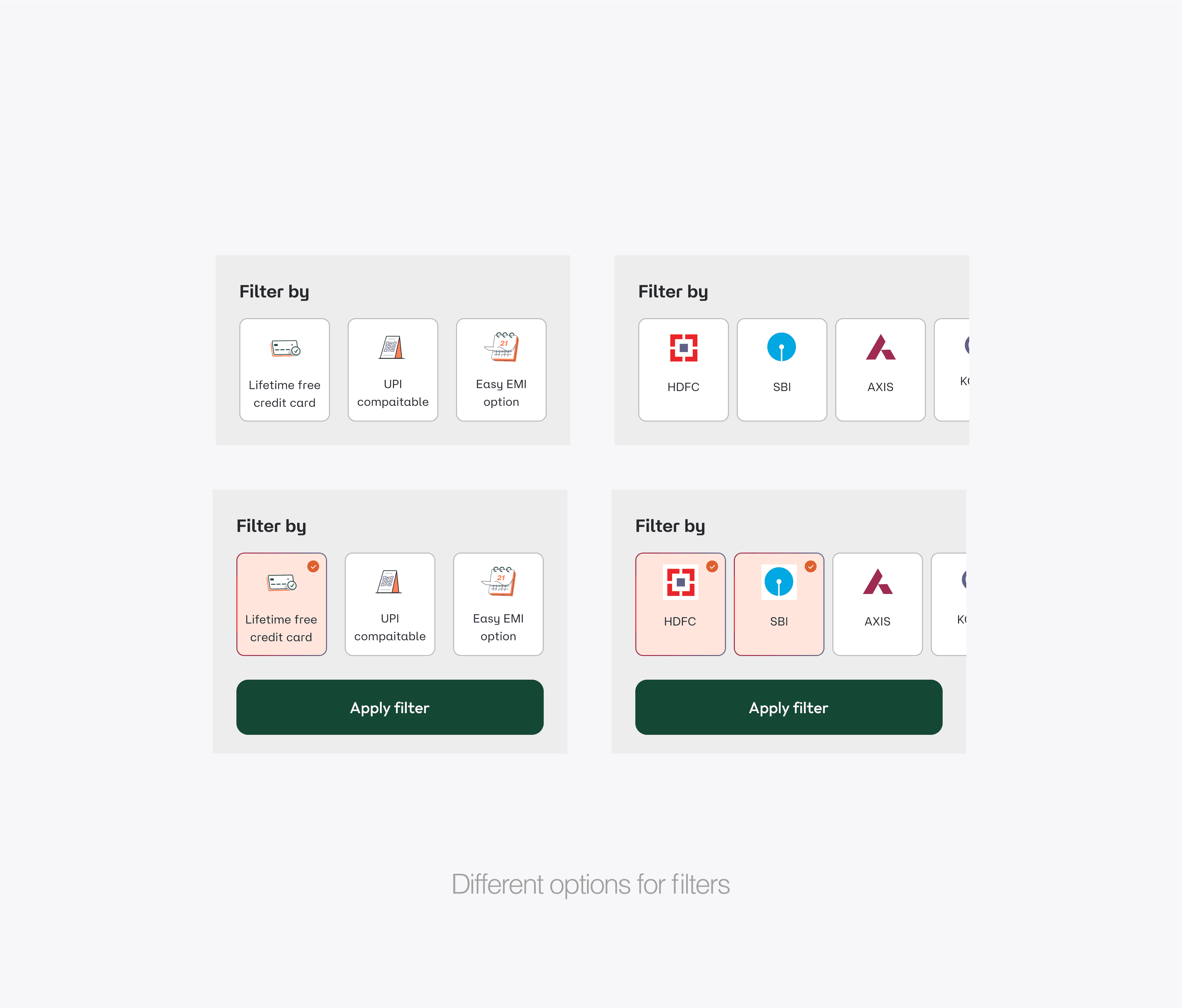

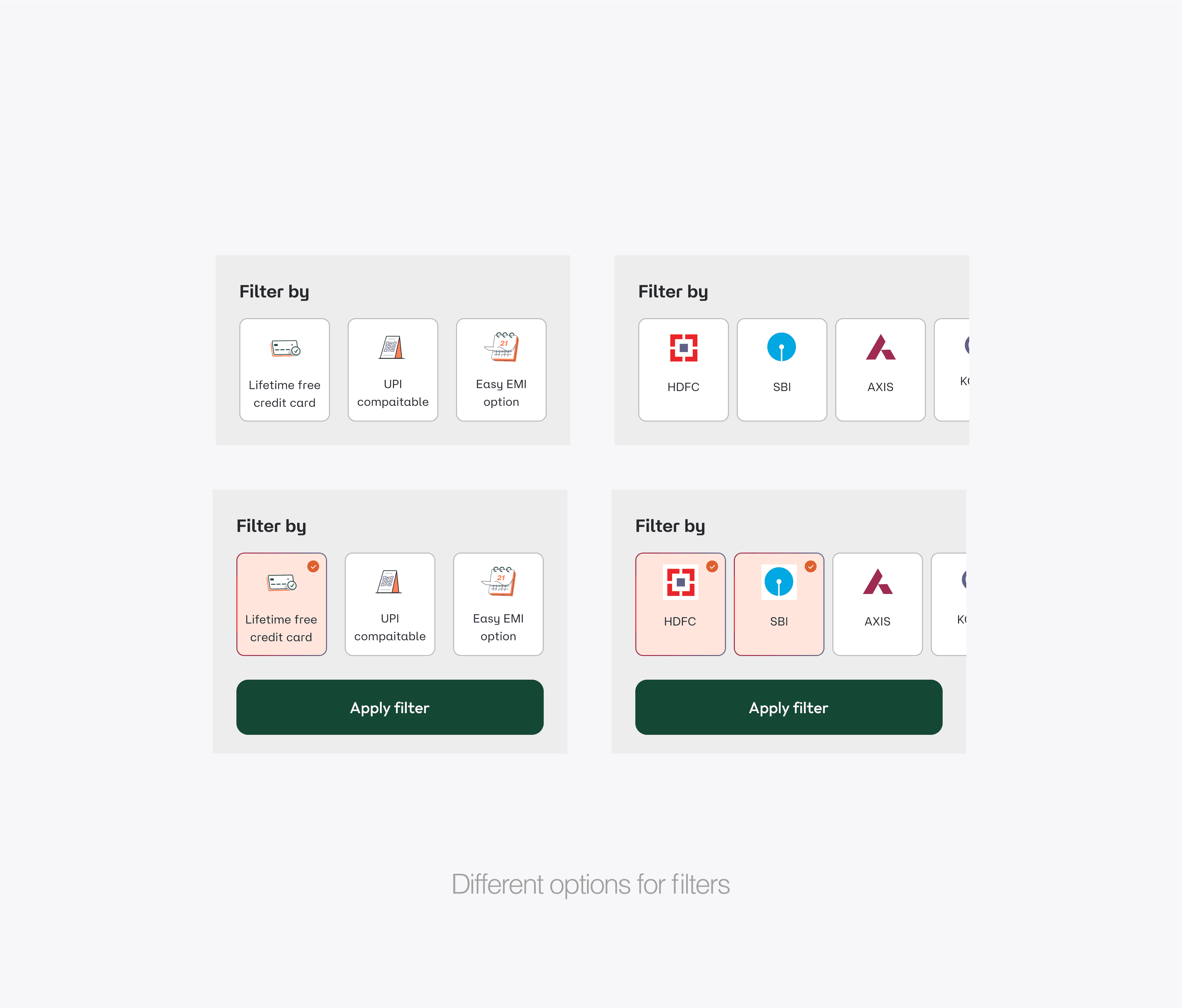

Enhanced Filtering Intelligence

Enhanced Filtering Intelligence

Filter FAB Innovation Implemented a contextual floating action button that activates a full-screen filtering experience. Smart categorization across fees, banks, benefits, and payment networks with real-time feedback showing "12 cards found" as users adjust parameters.

Gesture-Based Navigation Introduced intuitive interactions:

Tap-to-switch between tabs

Scroll-to-progress through card recommendations

Swipe gestures for seamless lateral navigation

Filter FAB Innovation Implemented a contextual floating action button that activates a full-screen filtering experience. Smart categorization across fees, banks, benefits, and payment networks with real-time feedback showing "12 cards found" as users adjust parameters.

Gesture-Based Navigation Introduced intuitive interactions:

Tap-to-switch between tabs

Scroll-to-progress through card recommendations

Swipe gestures for seamless lateral navigation

/MEASURED IMPACT

/MEASURED IMPACT

Transformational Results Through Integration

Transformational Results Through Integration

50%

reduction in application abandonment

83%

reduction in form fields before card visibility

While final metrics are still being collected, early indicators show:

Significantly reduced form abandonment rates

Increased time spent in discovery phase (indicating confidence-building)

Higher application completion rates

Reduced customer support inquiries about application status

While final metrics are still being collected, early indicators show:

Significantly reduced form abandonment rates

Increased time spent in discovery phase (indicating confidence-building)

Higher application completion rates

Reduced customer support inquiries about application status

While final metrics are still being collected, early indicators show:

Significantly reduced form abandonment rates

Increased time spent in discovery phase (indicating confidence-building)

Higher application completion rates

Reduced customer support inquiries about application status

Behavioral Shifts:

Behavioral Shifts:

Users began treating the platform as a financial education tool rather than just an application portal.

Users began treating the platform as a financial education tool rather than just an application portal.

/FOOTNOTE

/FOOTNOTE

BEYOND INTERFACE DESIGN

BEYOND INTERFACE DESIGN

⚘ Credit Card Discovery's evolution reflects my growth in understanding financial UX. I'm proud of how this project taught me that design isn't about making things look better—it's about making complex decisions feel manageable.

Working on financial empowerment through design became a defining moment in my approach to product strategy.

⚘ Credit Card Discovery's evolution reflects my growth in understanding financial UX. I'm proud of how this project taught me that design isn't about making things look better—it's about making complex decisions feel manageable.

Working on financial empowerment through design became a defining moment in my approach to product strategy.